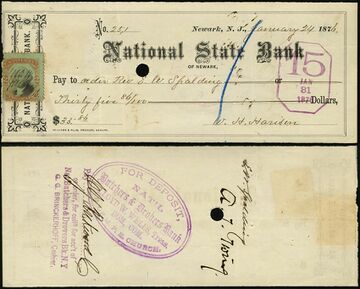

National State Bank, Newark, NJ (Charter 1452)

National State Bank, Newark, NJ (Chartered 1865 - Closed (Merger) 1994)

Town History

Newark (/ˈnjuːərk/ NEW-ərk, locally [nʊək]) is the most populous city in the U.S. state of New Jersey, the county seat of Essex County, and a principal city of the New York metropolitan area. As of the 2020 census, the city's population was 311,549. In 1860 the population was 71,941, peaking in 1930 at 442,337.

Settled in 1666 by Puritans from New Haven Colony, Newark is one of the oldest cities in the United States. Its location at the mouth of the Passaic River, where it flows into Newark Bay, has made the city's waterfront an integral part of the Port of New York and New Jersey. Port Newark–Elizabeth is the primary container shipping terminal of the busiest seaport on the U.S. East Coast. Newark Liberty International Airport was the first municipal commercial airport in the United States and has become one of the busiest. The name of the city is thought to derive from Newark-on-Trent, England.

Several companies are headquartered in Newark, including Prudential, PSEG, Panasonic Corporation of North America, Audible.com, IDT Corporation, Manischewitz, and AeroFarms. Higher education institutions in the city include the Newark campus of Rutgers University, which includes law and medical schools and the Rutgers Institute of Jazz Studies; University Hospital; the New Jersey Institute of Technology; and Seton Hall University's law school. Newark is a home to numerous governmental offices, largely concentrated at Government Center and the Essex County Government Complex. Cultural venues include the New Jersey Performing Arts Center, Newark Symphony Hall, the Prudential Center, The Newark Museum of Art, and the New Jersey Historical Society. Branch Brook Park is the oldest county park in the United States and is home to the nation's largest collection of cherry blossom trees, numbering over 5,000.

Newark had 22 National Banks chartered during the Bank Note Era, and 16 of those banks issued National Bank Notes.

Bank History

- Organized June 19, 1865

- Chartered July 17, 1865

- Conversion of The State Bank of Newark

- Bank was Open past 1935

- For Bank History after 1935 see FDIC Bank History website

- Merged into First Fidelity Bank, N.A. in Salem, NJ, January 11, 1994

The State Bank at Newark, New Jersey, was incorporated in 1812.

On January 27, 1854, Elias Van Arsdale, president of the State Bank at Newark, died at Trenton of paralysis. Mr. Van Arsdale was a lawyer and a prominent member of the Democratic Party of New Jersey.[2] In 1845 the honorary degree of LL.D. was conferred on Mr. Arsdale, Esq.[3]

On July 17, 1865, the National State Bank of Newark, New Jersey, capital $600,000, received its charter. Charles S. Macknet was president and Isaac Gaston, cashier.[4]

As of July 13, 1956, the First National Bank of Millburn was merged with the National State Bank of Newark. George W. Pultz, formerly vice president, trust officer and director of the First National Bank of Millburn was named assistant vice president of the National State Bank of Newark and manager of the Millburn-Short Hills Office. With the consolidation the complete facilities of one of the best equipped trust departments in the metropolitan area were now available to the residents of Millburn, Short Hills and nearby communities. The Millburn-Short Hills office was located at 397 Millburn Avenue, Millburn, New Jersey. Mr. Pultz had been connected with the local bank since January 23, 1923. He was appointed assistant trust officer in 1926, cashier in 1929, cashier and trust officer in 1930, and vice president and trust officer in 1945. The First National Bank of Millburn was established in 1907.[5]

In January 1965, the directors were W. Paul Stillman, chairman of the board; Junior C. Buck, president, Hahne & Co., director, Associated Dry Goods Corp.; John J. Clancy, lawyer; Nicholas Dekker, vice chairman, the Continental Insurance Companies; Thomas T. Dunn, executive vice president, Union Bag-Camp Paper Corp.; Herbert M. Ellend, lawyer and chairman of the finance committee, The Prudential Insurance Co. of America; Frederick H. Groel, executive vice president, The Prudential Insurance Co. of America; James V. Igoe, member, New York Stock Exchange; Albert R. Jube, vice chairman of the board, Collins & Aikman Corp.; William H. Keith, president; Roy H. Kirch, chairman of the board, Edwin A. Kirch & Co.; William B. Licklider, president, United States Savings Bank of Newark, New Jersey; Lyle McDonald, director and chairman of the finance committee, Public Service Electric & Gas Co.; Robert B. Meyner, counselor-at-law, Meyner & Wiley; Hobart C. Ramsey, former chairman, Worthington Corp.; M. Wilfred Rice, vice chairman; Clarence W. Slocum, Fanwood, New Jersey; Louis Stein, president, Food Fair Stores, Inc.; Harry A. Taylor, Sr., chairman of the board, Frank H. Taylor & Son, Inc.; George B. Underwood, president, Underwood Mortgage & Title Co.; Milford A. Vieser, chairman of the Finance Committee, Mutual Benefit Life Insurance Co.. Honorary directors were Charles J. Roh and John S. Thompson. The bank operated 23 offices with its main office at 810 Broad Street, Newark, New Jersey.[6] The National State Bank of Newark reported net operating income for 1964 at $4,843,097 compared with $4,413,247 in 1963. This represented earnings per share of $3.19 for 1964 compared with $2.90 in 1963, an increase of 10%. Total capital funds were $61,466,000 compared with $44,829,000 in 1963. Total resources at year end were $626,914,605 against $583,443,005 the year before.[7] On January 17, 1965, William H. Keith, 53, president of the National State Bank of Newark, died in his Westfield home. He was a former president of the New Jersey Bankers' Association.[8] On Tuesday, January 26, 1965, stockholders overwhelmingly approved the change of name at their annual meeting. They also elected 22 directors of whom 19 were re-elected. Elected to the bank for the first time was Robert R. Ferguson Jr., of Verona, executive vice president of the bank, and William E. Matchett of Summit, president of Continental Insurance Companies. Ferguson replaced the late president, William H. Keith. Matchett replaced Hobart C. Ramsey, who did not stand for re-election. Also elected was Frederick J. Kugelmann of Orange, senior vice president who served on the board early the previous year.[9] Ratification of the name change came in February from Comptroller of the Currency James J. Saxon. The bank's chairman of the board W. Paul Stillman said confusion existed over the similarity of names between the National State Bank of Newark and the National State Bank of Elizabeth. The use of the word "First" in the new title stems from the fact that National State in 1956 acquired the assets and name of the First National Bank of Millburn and had the right to use any part of that name.[10]

In February 1968, American Banker reported New Jersey's largest bank, First National State Bank of Newark, was 71st in the country with deposits of $710,999,609 at the end of 1967. It was followed by Fidelity Union Trust Co., Newark, $600,470,350, 87th in the nation; National Newark and Essex Bank, Newark, $550,968,959, 95th in the nation; and Peoples Trust Co. of Bergen County, $428,247,549, 120th in the nation.[11]

On Thursday, October 16, 1969, shareholders of the First National State Bank of New Jersey approved a plan to establish a bank holding company to be known as First National State Bancorporation. The bank would become a wholly owned subsidiary of the holding company. Shareholders approved a merger agreement and reorganization plan which provided that shareholders of the bank would become shareholders of the new holding company. Stock would be exchanged on a one for one basis. The reorganization was subject to approval by the comptroller of the currency and other regulatory agencies.[12]

In October 1970, stockholders of the Orange Valley Bank, Orange, approved a merger with First National State Bank, the largest commercial bank in the state and the principal bank in the new Bancorporation. Bancorporation now had affiliates in Essex, Middlesex, Berge, Warren, and Monmouth Counties.[13] Three additional banks affiliating with First National State Bancorporation were The Edison Bank with headquarters in South Plainfield; City National Bank, Hackensack (Charter 12014); and First National Bank of Spring Lake (Charter 13898). Shareholders of Warren County National Bank, Washington, already approved the plan the effect of which would be to create New Jersey's first billion dollar banking corporation.[14]

In January 1983, First National State Bank of West Jersey, the newest affiliate of First National State Bancorporation, was formed following completion of the merger of the former Hunterdon County National Bank of Flemington and First National State Bank of Northwest Jersey in Succasunna. The West Jersey bank had its headquarters in Flemington with 20 branches in Hunterdon, Morris, Warren and Sussex counties. The chairman and chief executive officer was Richard F. Schaub, former president of the Hunterdon County bank. The president and chief administrative officer of the new bank was Thayer Talcott, Jr., formerly president of First National State of Northwest Jersey. First National State Bank of West Jersey had assets of more than $388 million and deposits of about $340 million.[15] By December 1983,First National State Bancorporation's six member banks had over 190 branch offices in all 21 counties of the state. It was the largest banking organization in the state with assets of $6.1 billion.[16]

In November 1984, First Fidelity was formed from the combination of First National State Bank and Fidelity Union Bank. First Fidelity ranked among the nation's top financial organizations with more than $10 billion in assets. Members of First National State Bancorporation were First Fidelity Bank, N.A., New Jersey; First Fidelity Bank, N.A. North Jersey; First Fidelity Bank, N.A. South Jersey; First Fidelity Bank, N.A. West Jersey; and First Fidelity Bank, N.A. County.[18]

In January 1991, Douglas E. Johnson was chief executive officer of Statewide Bancorp, the parent company of First National Bank of Toms River. The bank celebrated its 110th anniversary by serving birthday cupcakes to all customers in its 50 branches. Some of the cupcake distribution was done personally by the bank's president and chief executive officer Douglas Johnson. The bank was chartered on March 7, 1881 and opened its doors for business three days later. It was now the eighth largest bank in the state. The bank also provided apples to customers in the fall, candy kisses on Valentine's Day and daffodils in the spring.[19] Ocean County's largest bank lost an estimated $22 million in the 4th quarter of 1990 pushing its loss for the year to $110 million according the Sheshunoff Information Services. Sheshunoff reported that the institution's defaulted loans climbed 43% in the fourth quarter, a clear sign of problems worsening at First National.[20] In May Statewide Bancorp agreed to sell seven of its branches in Salem and Atlantic counties to First Peoples Bank of New Jersey, located in Haddon Township. The Atlantic County branches belonged to First National Bank of Toms River and the Salem County branches to Statewide's other subsidiary, the First National Bank of New Jersey/Salem County. The branch sale was one of several steps take by Statewide to bolster its equity capital and that of its principal subsidiary, First National Bank of Toms River.[21] First National was left with 44 branches in Ocean, Cape May, Burlington, and Monmouth Counties. The branches sold were in Pomona, Egg Harbor City and Hammonton in Atlantic County and Penns Grove (2), Woodstown, Carney's Point and Pennsville in Salem County. Jerome S. Goodman was president and CEO of First Peoples, the largest commercial bank based in South Jersey operating 32 branches in Camden, Burlington, Cumberland and Gloucester Counties with $1 billion in assets.[22] Statewide Bancorp announced a fourth quarter loss of $76 million bringing the 1990 loss to a record $165.8 million pushing the bank towards insolvency. According to President Johnson, a potential merger was being discussed with two regional banking companies.[23] On Wednesday, May 22, the 110-year old First National bank of Toms River was declared insolvent and would reopen its branches as part of the state's largest bank. Lawrenceville-based First Fidelity Bancorp would assume about $1.6 billion in 259,100 depositor accounts according to the Federal Deposit Insurance Corp. First Fidelity acquired the bank from the FDIC which was named receiver for First National. The FDIC said First Fidelity would assume liability of about $1.7 billion of First National's failed assets. The FDIC paid First Fidelity $85 million to assume those liabilities. Tony Terracciano, First Fidelity chairman and chief executive officer said, "This purchase fits our growth strategy." The acquisition provided First Fidelity increased market share in Ocean County which was New Jersey's fastest growing county.[24]

- 12/04/1970 Acquired Orange Valley Bank (FDIC #10229) in Orange, NJ.

- 01/10/1976 Acquired The Bank of Bloomfield (FDIC #18798) in Bloomfield, NJ.

- 10/09/1983 Changed Institution Name to First National State Bank.

- 11/01/1984 Acquired Fidelity Union Bank/First National State (FDIC #17581) in Newark, NJ.

- 06/05/1987 Acquired First Fidelity Bank, National Association, County (FDIC #6343) in Tenafly, NJ.

- 01/11/1991 Acquired City Savings, FSB (FDIC #33150) in Elizabeth, NJ.

- 04/13/1991 Acquired First Fidelity Bank, Princeton (FDIC #26679) in Monmouth Junction, NJ.

- 05/22/1991 Acquired The First National Bank of Toms River, N.J. (Charter 2509) (FDIC #6499) in Toms River, NJ.

- 09/27/1991 Main Office moved to 550 Broad Street, Newark, NJ 07102.

- 09/27/1991 Acquired Morris Savings Bank (FDIC #16143) in Morristown, NJ.

- 10/02/1992 Acquired The Howard Savings Bank (FDIC #16146) in Newark, NJ.

- 10/02/1992 Acquired The Howard Federal Savings, FA (FDIC #28852) in Berlin, NJ.

- 11/12/1992 Acquired First Fidelity Bank, National Association, North Jersey (FDIC #6301) in Totowa, NJ.

- 03/18/1993 Acquired First Fidelity Bank, National Association, South Jersey (FDIC #6456) in Burlington Township, NJ.

- 01/11/1994 Merged and became part of First Fidelity Bank, National Association (FDIC #33869) in Salem, NJ.

- 01/01/1996 Changed Institution Name to First Union National Bank.

- 04/01/2002 Changed Institution Name to Wachovia Bank, National Association.

- 03/20/2010 Merged and became part of Wells Fargo Bank, National Association (FDIC #3511) in Sioux Falls, SD.

Official Bank Title

1: The National State Bank of Newark, NJ

Bank Note Types Issued

A total of $8,908,920 in National Bank Notes was issued by this bank between 1865 and 1935. This consisted of a total of 877,451 notes (766,852 large size and 110,599 small size notes).

This bank issued the following Types and Denominations of bank notes:

Series/Type Sheet/Denoms Serial#s Sheet Comments Original Series 3x1-2 1 - 14500 Original Series 4x5 1 - 13850 Original Series 3x10-20 1 - 6720 Original Series 50-100 1 - 2280 Series 1875 3x1-2 1 - 880 Series 1875 4x5 1 - 8250 Series 1875 3x10-20 1 - 2200 Series 1875 50-100 1 - 4688 1882 Brown Back 50-100 1 - 4898 1902 Red Seal 50-100 1 - 706 1902 Date Back 4x5 1 - 27000 1902 Date Back 3x10-20 1 - 15500 1902 Date Back 50-100 1 - 1700 1902 Date Back 3x50-100 1 - 1738 1902 Plain Back 4x5 27001 - 87775 1902 Plain Back 3x10-20 15501 - 48172 1902 Plain Back 3x50-100 1739 - 2230 1929 Type 1 6x5 1 - 8454 1929 Type 1 6x10 1 - 4206 1929 Type 1 6x20 1 - 1174 1929 Type 1 6x50 1 - 500 1929 Type 1 6x100 1 - 134 1929 Type 2 5 1 - 13014 1929 Type 2 10 1 - 7625 1929 Type 2 20 1 - 3152

Bank Presidents and Cashiers

Bank Presidents and Cashiers during the National Bank Note Era (1865 - 1935):

Presidents:

- Charles S. Macknet, 1865-1870

- William Buchan Mott, 1871-1877

- Theodore Macknet, 1878-1888

- John Prosser Jube, 1889-1892

- James F. Bless, 1893-1910

- William I. Cooper, 1911-1930

- William Paul Stillman, 1931-1935

Cashiers:

- Isaac Gaston, 1865-1877

- William Rockwell, 1878-1908

- William I. Cooper, 1909-1910

- Arthur W. Greason, Sr., 1911-1930

- William Stuart Leonard, 1931-1933

- Willibald August Theuer, 1934-1935

Other Known Bank Note Signers

Bank Note History Links

Sources

- Newark, NJ, on Wikipedia

- Don C. Kelly, National Bank Notes, A Guide with Prices. 6th Edition (Oxford, OH: The Paper Money Institute, 2008).

- Dean Oakes and John Hickman, Standard Catalog of National Bank Notes. 2nd Edition (Iola, WI: Krause Publications, 1990).

- Banks & Bankers Historical Database (1782-1935), https://spmc.org/bank-note-history-project

- ↑ The News, Paterson, NJ, Thu., Nov. 15, 1984.

- ↑ Monmouth Democrat, Freehold, NJ, Thu., Feb. 9, 1854.

- ↑ Monmouth Democrat, Freehold, NJ, Thu., July 3, 1845.

- ↑ Washington Chronicle, Washington, DC, Fri., July 21, 1865.

- ↑ The Item of Millburn and Short Hills, Millburn, NJ, Thu., Sep. 20, 1956.

- ↑ The Herald-News, Passaic, NJ, Tue., Jan. 12, 1965.

- ↑ The Star-Ledger, Newark, NJ, Fri., Jan. 8, 1965.

- ↑ Daily News, New York, NY, Mon. Jan. 18, 1965.

- ↑ The Star-Ledger, Newark, NJ, Wed., Jan. 27, 1965.

- ↑ The Star-Ledger, Newark, NJ, Mon., Feb. 15, 1965.

- ↑ The Record, Hackensack, NJ, Thu., Feb. 1, 1968.

- ↑ The Morning Call, Paterson, NJ, Fri., Oct. 17, 1969.

- ↑ The Central New Jersey Home News, New Brunswick, NJ, Fri., Oct. 30, 1970.

- ↑ The Jersey Journal, Jersey City, NJ, Sat., Oct. 31, 1970.

- ↑ The Star-Ledger, Newark, NJ, Sun, Jan. 2, 1983.

- ↑ The Herald-News, Passaic, NJ, Fri., Dec. 9, 1983.

- ↑ The News, Paterson, NJ, Thu., Nov. 15, 1984.

- ↑ The News, Paterson, NJ, Thu., Nov. 15, 1984.

- ↑ The Star-Ledger, Newark, NJ, Thu., Mar. 21, 1991.

- ↑ Asbury Park Press, Asbury Park, NJ, Fri., Apr. 12, 1991.

- ↑ Press of Atlantic City, Atlantic City, NJ, Wed., May 1, 1991.

- ↑ The Star-Ledger, Newark, NJ, Wed., May 1, 1991.

- ↑ Daily Record, Morristown, NJ, Sun., May 5, 1991.

- ↑ Daily Record, Morristown, NJ, Thu., May 23, 1991.