Florida National Bank, Jacksonville, FL (Charter 8321)

Florida National Bank, Jacksonville, FL (Chartered 1906 - Closed (Merger) 1990)

Town History

Jacksonville is the most populous city in Florida, and is the largest city by area in the contiguous United States as of 2020. It is the seat of Duval County, with which the city government consolidated in 1968. Consolidation gave Jacksonville its great size and placed most of its metropolitan population within the city limits. As of 2020, Jacksonville's population is 949,611, making it the 12th most populous city in the U.S., the most populous city in the Southeast, and the most populous city in the South outside of the state of Texas. With a population of 1,605,848, the Jacksonville metropolitan area ranks as Florida's fourth-largest metropolitan region.

Jacksonville is centered on the banks of the St. Johns River in northeast Florida, about 25 miles south of the Georgia state line and 328 miles north of Miami. The Jacksonville Beaches communities are along the adjacent Atlantic coast.

Harbor improvements since the late 19th century have made Jacksonville a major military and civilian deep-water port. Its riverine location facilitates Naval Station Mayport, Naval Air Station Jacksonville, the U.S. Marine Corps Blount Island Command, and the Port of Jacksonville, Florida's third largest seaport. Jacksonville's military bases and the nearby Naval Submarine Base Kings Bay form the third largest military presence in the United States. Significant factors in the local economy include services such as banking, insurance, healthcare and logistics. As with much of Florida, tourism is important to the Jacksonville area, particularly tourism related to golf. People from Jacksonville are sometimes called "Jacksonvillians" or "Jaxsons" (also spelled "Jaxons").

Jacksonville had 10 National Banks chartered during the Bank Note Era, and nine of those banks issued National Bank Notes. Jacksonville also had two Obsolete Banks that issued Obsolete Bank Notes during the Obsolete Bank Note Era (1782-1866).

Bank History

- Organized July 16, 1906

- Chartered August 7, 1906

- Conversion of The Florida Bank and Trust Company

- Opened for business August 9, 1906

- Bank was Open past 1935

- For Bank History after 1935 see FDIC Bank History website

- Merged into First Union National Bank of Florida in Jacksonville, FL, March 1, 1990

- Florida National Bank on Wikipedia

Mercantile Exchange Bank

Samuel B. Hubbard of Jacksonville, was only a few days over seventy years of age at the time of his death on June 21st, 1903. He came to Jacksonville in 1866. He was born in Wadesboro, North Carolina, his father being Charles Hubbard, who belonged. to a prominent family in Middletown, Connecticut. After living four years at Wadesboro, the parents returned to Middletown, taking the child with them. Just before the Civil War Mr. Hubbard went to Pine Bluff, Arkansas, where he engaged in business up to the time of the breaking out of the war, when he returned home. Much that is identified with the history of the growth and development of Jacksonville is connected with his career. The sound business judgment and financial ability of the deceased enabled him to achieve a success in the business world which made his name known throughout the entire state of Florida, and finally the whole South. The immense hardware establishment bearing his name was one of the strongest firms of the kind in the entire South. It was organized in 1866 by Mr. Hubbard. In recent years he devoted considerable time to his other enterprises, among which was the Mercantile Exchange Bank. This institution was organized in 1888, as the Southern Savings and Trust Company. The name was changed in 1900. The bank met with success from the outset, and was one of Mr. Hubbard's favorite achievements. In the upbuilding of what became the Springfield suburb, Mr. Hubbard had an important part. In 1883 he formed the Springfield Company, which organization bought the Hogan grant, embracing the present suburb, and the company devoted itself to developing this property. Mr. Hubbard also formed the Main Street Railroad Company, of which he was president.[6]

Florida Bank and Trust Company

Plans were in place to open one of the largest banking houses in the South on January 5, 1905. This was another step in the development of Jacksonville whose growth had been phenomenal since the great fire of a little more than three years ago. This banking house would be the Florida Bank and Trust Company. The capital stock would be $500,000 at least, and probably $1,000,000. It planned to do a general banking, savings bank, trust and surety business. W.F. Coachman would be president, Gov. W.S. Jennings was tendered the position of vice president in charge of the trust and surety department, and Arthur F. Perry would become vice president in charge of the banking department. These three executive officers would have entire charge of the business of the corporation. They would give the trust company Jacksonville men of experience, well-known in financial circles. Florida and Jacksonville were developing at a rapid rate. Great industrial and commercial institutions were centered there and when deep water access to Jacksonville would make it a cotton market as well as lumber, naval stores and phosphate market, the big interests would need to find in successful operation a bank with sufficient capital to meet their requirements.[7] The Florida Bank and Trust Company began business in January 1905, taking over the business of the Mercantile Exchange Bank which had deposits amounting to $1,319,938.[8]

In June 1905, the officers of the Florida Bank and Trust Company were W.F. Coachman, president; W.S. Jennings, vice president; Arthur F. Perry, vice president; W.A. Redding cashier; and F.P. Fleming, Jr., trust officer.[9] Mr. Coachman was president of the new Naval Stores Export Company which agreed to take all naval stores shipped to Jacksonville, Fernandina and Tampa at prices quoted on the Savannah Board of Trade on the day of arrival. This arrangement went into effect June 1st and until that time, Jacksonville was a closed port.[10]

The Florida National Bank of Jacksonville

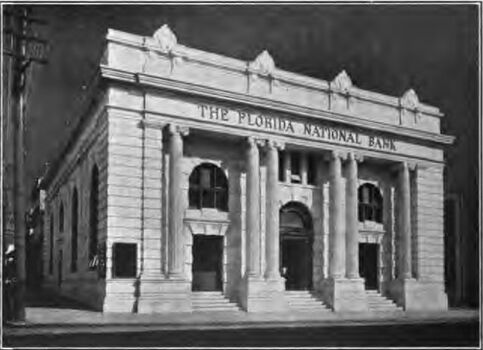

On Thursday, August 9, 1906, a new national bank opened its doors in Jacksonville. The Florida National Bank of Jacksonville was a conversion of the Florida Bank and Trust Company and was designated by Secretary Shaw of the Treasury Department as a United States depository.[11] Mr. C.E. Garner was the president; Mr. C.B. Rogers, vice president; and Mr. W.A. Redding, formerly of Ocala, was its cashier.[12]

On March 22, 1907, the statement submitted to the Comptroller showed total resources of $3,325,533.60 with capital $500,000, surplus $30,000, undivided profits $29,702.83, circulation $50,000, and deposits $2,693,788.77.

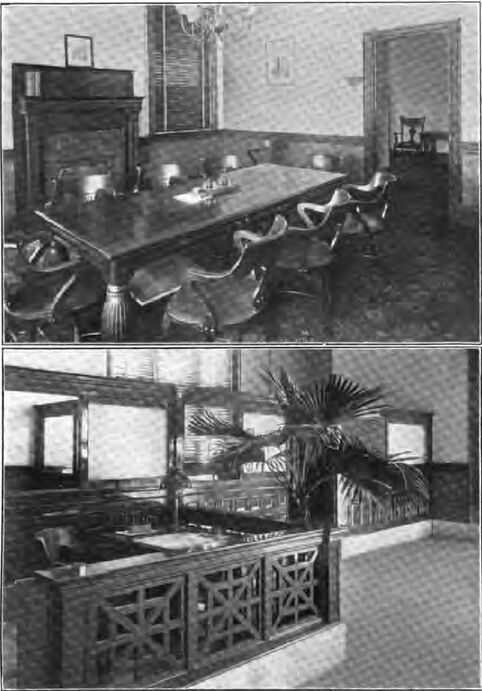

Entering the center door one faced the cashier whose desk was in the center of the railed enclosure. From this position he had direct supervision over the entire business of the bank. At the left of the entrance, a railed enclosure comfortably fitted with desks, etc., was reserved exclusively for the use of ladies. On the right a series of handsomely fitted private offices extended from the front to the rear of the building. The first was known as the "customers' room" and was a new feature. Next were the offices of the vice presidents while at the rear was the president's room, approached by an ante-room. A large directors' room and committee room occupied the northwest corner of the building. Another feature of the building were safe deposit boxes on the main floor with adjacent booths where the owner of a box could examine its contents privately.[13]

On April 18, 1929, directors of the Florida National Bank and the Barnett National Bank, two of the largest banking institutions in the state, approved a plan for consolidation which would give the city a bank capitalized at approximately $45,000,000. By the terms of the merger agreement, Bion H. Barnett, chairman of the board of the Barnett bank, would become chairman of the executive committee of the institution. Arthur F. Perry, president of the Florida National, would become chairman of the board, and William R. McQuaid, president of the Barnett, would continue in the same capacity for the consolidated institution. It was understood the merger was contingent upon the passage by the legislature of an amendment to the state banking act, which would be introduced immediately, and which would provide that a bank formed by a merger in one town or city may transact business in two banking houses formerly used by the banks so uniting.[14]

On Tuesday, October 22, 1929, Edward Ball, vice president of Almours Securities Inc., the $200,000,000 Florida corporation headed by Alfred I. DuPont with its headquarters in Jacksonville, stated plans for extensive developments in Florida. Mr. duPont became interested in Florida several years earlier with the purchase of 43,000 acres of water front property in West Florida in the vicinity of Port St. Joe, Panama City and Camp Walton. Recently the duPont organization became interested in the banking business. A controlling interest was made in the Florida National Bank of Jacksonville and the establishment of two other national banks, one at Lakeland and the other at Bartow, and application for charters for others at Daytona Beach and Orlando and contemplation of setting up still others. All of the new banks had the name Florida National and were affiliated with the Florida National in Jacksonville. Those already established had combined resources of near $25 million. Mr. duPont also held several parcels of valuable downtown property in Jacksonville and since becoming an investor in the state had erected one of the handsomest residences in Florida at San Jose facing on the St. Johns River.[15]

In February 1930, Alfred I. duPont, whose holdings in Florida had greatly increased in the last year, took over the presidency of the Florida National Bank and assumed actual control over the smaller Florida National outposts that had been set up in Lakeland and other cities hit by closed banks the previous summer. Arthur F. Perry, former president of the Florida National and an outstanding man in state banking circles, went to the Barnett National as a director and vice chairman of the board. Consolidation of banking manpower in two of the three big Jacksonville national banks would do much to increase confidence of Northern depositors in Florida banks. The consolidation also meant that in north and central Florida the bulk of financial matters would be in the hands of one of two powerful groups, either the Atlantic National Bank group or the group in which the Barnett National and the Florida National of Jacksonville had just been joined by a personal bond. An attempt was made in the legislature of 1929 to pass a law enabling the Florida and the Barnett to combine, but to occupy their existing two banking buildings. This was vetoed by national bank supervisors and the merger was dropped. With such institutions as the First National, City National, and Bank of Bay Biscayne in Miami, and the Atlantic National, Florida National and Barnett National in Jacksonville in more or less control of the banking situation along the East Coast and through the body of Florida, there was little fear of financial instability.[16]

- 02/20/1978 Acquired Florida Northside Bank of Jacksonville (FDIC #17817) in Jacksonville, FL.

- 02/20/1978 Acquired Florida Dealers and Growers Bank (FDIC #17301) in Jacksonville, FL.

- 02/20/1978 Acquired Florida National Bank at Lake Shore (FDIC #18520) in Jacksonville, FL.

- 02/20/1978 Acquired Florida National Bank at Arlington (FDIC #17516) in Jacksonville, FL.

- 11/01/1980 Changed Institution Name to Florida National Bank of Jacksonville.

- 11/01/1980 Acquired The Florida First National Bank at Fernandina Beach (FDIC #3562) in Fernandina Beach, FL.

- 01/15/1982 Acquired The Florida National Bank at Gainesville (FDIC #5674) in Gainesville, FL.

- 04/08/1983 Acquired Peoples Bank of St. Augustine (FDIC #23022) in Saint Augustine, FL.

- 07/01/1983 Acquired Florida National Bank of Palm Beach County (FDIC #15473) in West Palm Beach, FL.

- 07/01/1983 Acquired Florida National Bank at Vero Beach (FDIC #17757) in Vero Beach, FL.

- 07/01/1983 Acquired Florida National Bank of Martin County (FDIC #18578) in Stuart, FL.

- 07/01/1983 Acquired Florida Bank at Starke (FDIC #15464) in Starke, FL.

- 07/01/1983 Acquired Florida National Bank of Pinellas County (FDIC #3587) in St. Petersburg, FL.

- 07/01/1983 Acquired Florida National Bank at Port St. Joe (FDIC #15719) in Port Saint Joe, FL.

- 07/01/1983 Acquired Florida National Bank at Pensacola (FDIC #3584) in Pensacola, FL.

- 07/01/1983 Acquired The Florida National Bank at Orlando (FDIC #1345) in Orlando, FL.

- 07/01/1983 Acquired Florida National Bank at Ocala (FDIC #3581) in Ocala, FL.

- 07/01/1983 Acquired Florida National Bank of Miami (FDIC #3576) in Miami, FL.

- 07/01/1983 Acquired The Florida National Bank at Lakeland (FDIC #3571) in Lakeland, FL.

- 07/01/1983 Acquired Florida Bank at Fort Pierce (FDIC #16319) in Fort Pierce, FL.

- 07/01/1983 Acquired Florida Bank of Volusia County (FDIC #135) in Daytona Beach, FL.

- 07/01/1983 Acquired Florida Bank of Sumter County (FDIC #16508) in Bushnell, FL.

- 11/01/1983 Acquired Tropic Bank of Seminole (FDIC #20936) in Casselberry, FL.

- 01/01/1984 Acquired Flagship Bank of Lake County (FDIC #5667) in Tavares, FL.

- 01/01/1984 Acquired Sun Bank/Hillsborough (FDIC #17981) in Tampa, FL.

- 01/01/1984 Acquired Flagship Peoples Bank of Tallahassee (FDIC #18044) in Tallahassee, FL.

- 01/01/1984 Acquired Flagship First National Bank of Highlands County (FDIC #18572) in Sebring, FL.

- 03/03/1984 Acquired Royal Trust Bank (FDIC #21303) in Gulfport, FL.

- 03/03/1984 Acquired Royal Trust Bank of Florida, National Association (FDIC #15436) in St. Petersburg, FL.

- 03/03/1984 Acquired Royal Trust Bank of Palm Beach, N.A. (FDIC #20487) in Palm Beach, FL.

- 03/03/1984 Acquired Royal Trust Bank, National Association (FDIC #18877) in Miami, FL.

- 12/15/1984 Acquired Lighthouse National Bank (FDIC #21990) in Jupiter, FL.

- 03/10/1986 Main Office moved to 225 Water Street, Jacksonville, FL 32202.

- 06/04/1986 Acquired Citrus Park Bank (FDIC #21976) in Hillsborough County, FL.

- 12/22/1986 Acquired Southern National Bank of Broward County (FDIC #21487) in Broward County, FL.

- 03/01/1990 Merged and became part of First Union National Bank of Florida (FDIC #24398) in Jacksonville, FL.

- 06/05/1997 Merged and became part of First Union National Bank (FDIC #4885) in Charlotte, NC.

- 02/26/1998 Merged and became part of First Union National Bank (FDIC #33869) in Charlotte, NC.

- 04/01/2002 Changed Institution Name to Wachovia Bank, National Association.

- 03/20/2010 Merged and became part of Wells Fargo Bank, National Association (FDIC #3511) in Sioux Falls, SD.

Official Bank Title

1: The Florida National Bank of Jacksonville, FL

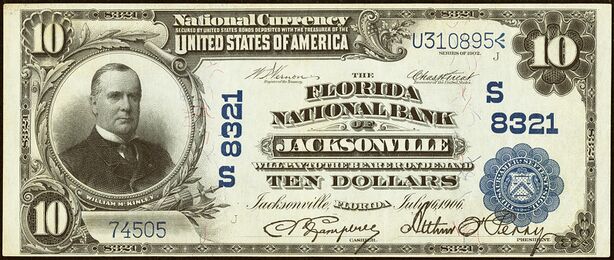

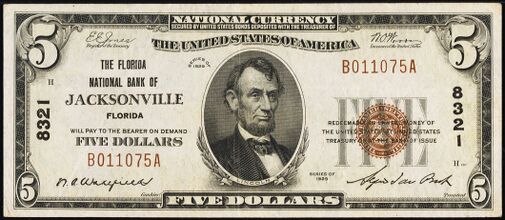

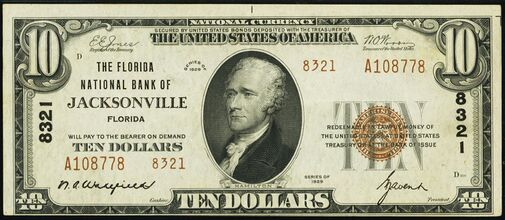

Bank Note Types Issued

A total of $13,488,450 in National Bank Notes was issued by this bank between 1906 and 1935. This consisted of a total of 1,877,480 notes (1,202,336 large size and 675,144 small size notes).

This bank issued the following Types and Denominations of bank notes:

Series/Type Sheet/Denoms Serial#s Sheet Comments 1902 Red Seal 4x5 1 - 4150 1902 Red Seal 4x10 1 - 6675 1902 Date Back 4x5 1 - 48000 1902 Date Back 4x10 1 - 46500 1902 Plain Back 4x5 48001 - 157275 1902 Plain Back 4x10 46501 - 132484 1929 Type 1 6x5 1 - 9477 1929 Type 1 6x5 9501 - 31916 1929 Type 1 6x10 1 - 4577 1929 Type 1 6x10 4773 - 22880 1929 Type 2 5 1 - 220212 1929 Type 2 10 1 - 127464

Bank Presidents and Cashiers

Bank Presidents and Cashiers during the National Bank Note Era (1906 - 1935):

Presidents:

- Charles Edwin Garner, 1906-1912

- Arthur F. Perry, 1913-1929

- Alfred Irénée du Pont, 1930-1932

- George J. Avent, 1933-1935

Cashiers:

- Wesley Albert Redding, Sr., 1906-1913

- George J. Avent, 1914-1919

- C. B. Campbell, 1920-1924

- J. A. Newson, 1925-1925

- Nathan Archibald Wakefield, 1926-1935

Other Known Bank Note Signers

- No other known bank note signers for this bank

Bank Note History Links

Sources

- Jacksonville, FL, on Wikipedia

- Don C. Kelly, National Bank Notes, A Guide with Prices. 6th Edition (Oxford, OH: The Paper Money Institute, 2008).

- Dean Oakes and John Hickman, Standard Catalog of National Bank Notes. 2nd Edition (Iola, WI: Krause Publications, 1990).

- Banks & Bankers Historical Database (1782-1935), https://spmc.org/bank-note-history-project

- ↑ The Bankers' Magazine, Vol. 74, Jan. - June 1907, p. 818.

- ↑ The Weekly Tribune, Tampa, FL, Thu., June 1, 1905.

- ↑ The Bankers' Magazine, Vol. 74, Jan. - June 1907, p. 819.

- ↑ The Bankers' Magazine, Vol. 74, Jan. - June 1907, p. 819.

- ↑ The Bankers' Magazine, Vol. 74, Jan. - June 1907, p. 821.

- ↑ The Ocala Evening Star, Ocala, FL, Mon., June 29, 1903.

- ↑ The Miami News, Miami, FL, Mon., Sep. 12, 1904.

- ↑ The Bankers' Magazine, Vol. 74, Jan. - June 1907, p. 818.

- ↑ The Weekly Tribune, Tampa, FL, Thu., June 1, 1905.

- ↑ The Sun, Jacksonville, FL, Sat., Dec. 9, 1905.

- ↑ Gainesville Daily Sun, Gainesville, FL, Sat., Aug. 11, 1906.

- ↑ The Ocala Banner, Ocala, FL, Fri., Aug. 17, 1906.

- ↑ The Bankers' Magazine, Vol. 74, Jan. - June 1907, p. 820-822.

- ↑ The Miami News, Miami, FL, Thu., Apr. 18, 1929.

- ↑ The Stuart News, Stuart, FL, Wed., Oct. 23, 1929.

- ↑ The Miami Herald, Miami, FL, Thu., Feb. 13, 1930.