Barnett National Bank, Jacksonville, FL (Charter 9049)

Barnett National Bank, Jacksonville, FL (Chartered 1908 - Closed (Merger) 1998)

Town History

Jacksonville is the most populous city in Florida, and is the largest city by area in the contiguous United States as of 2020. It is the seat of Duval County, with which the city government consolidated in 1968. Consolidation gave Jacksonville its great size and placed most of its metropolitan population within the city limits. As of 2020, Jacksonville's population is 949,611, making it the 12th most populous city in the U.S., the most populous city in the Southeast, and the most populous city in the South outside of the state of Texas. With a population of 1,605,848, the Jacksonville metropolitan area ranks as Florida's fourth-largest metropolitan region.

Jacksonville is centered on the banks of the St. Johns River in northeast Florida, about 25 miles south of the Georgia state line and 328 miles north of Miami. The Jacksonville Beaches communities are along the adjacent Atlantic coast.

Harbor improvements since the late 19th century have made Jacksonville a major military and civilian deep-water port. Its riverine location facilitates Naval Station Mayport, Naval Air Station Jacksonville, the U.S. Marine Corps Blount Island Command, and the Port of Jacksonville, Florida's third largest seaport. Jacksonville's military bases and the nearby Naval Submarine Base Kings Bay form the third largest military presence in the United States. Significant factors in the local economy include services such as banking, insurance, healthcare and logistics. As with much of Florida, tourism is important to the Jacksonville area, particularly tourism related to golf. People from Jacksonville are sometimes called "Jacksonvillians" or "Jaxsons" (also spelled "Jaxons").

Jacksonville had 10 National Banks chartered during the Bank Note Era, and nine of those banks issued National Bank Notes. Jacksonville also had two Obsolete Banks that issued Obsolete Bank Notes during the Obsolete Bank Note Era (1782-1866).

Bank History

- Organized February 25, 1908

- Chartered March 2, 1908

- Opened for business April 15, 1908

- Succeeded 3869 (National Bank, Jacksonville, FL)

- Bank was Open past 1935

- For Bank History after 1935 see FDIC Bank History website

- Merged into NationsBank, N.A. in Charlotte, NC, October 8, 1998

Barnett Bank was a private bank based in Florida, founded in 1877. It eventually became the largest commercial bank in Florida with over 600 offices and $41.2 billion in deposits. Barnett was purchased by NationsBank in 1997.

The Barnett National Bank was established in 1877 by W.B. Barnett as a private bank under the name of the Bank of Jacksonville. The original capital was $40,000 which was adequate at that time as Jacksonville was a mere village. Mr. Barnett was one of Jacksonville's pioneers and the bank enjoyed the confidence of the public. In 1888 the bank was nationalized and increased its capital to $150,000. Jacksonville continued to prosper and the business of the bank grew proportionately with the result that in 1903 the capital was increased to $300,000. In 1908 the charter of the National Bank of Jacksonville expired by limitation and on April 15, 1908, the Barnett National Bank was organized and succeeded to its business with a capital of $750,000, the bank named in honor of the founder, Mr. W.B. Barnett.

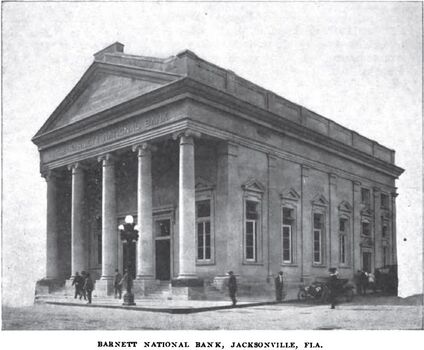

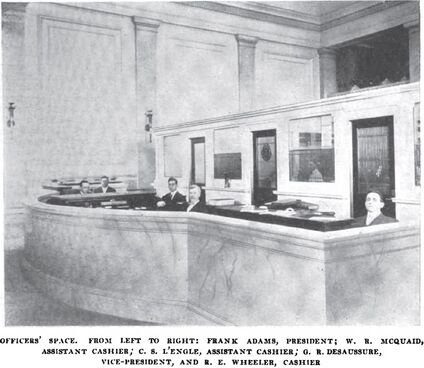

On March 18, 1912, after ten months of business in temporary quarters at the corner of Laura and Adams Streets (one block away from its permanent home), the Barnett National Bank opened the doors of its remodeled building and resumed business at its old stand located at the corner of Forsyth and Laura Streets. The supervising architect was George O. Holmes and L.M. Boykin was the contractor, both local men. Out of respect to the memory of W.B. Barnett, the founder of the bank, it was decided not to make any material change in the fine exterior of the building. Visitors entered through one of two front doors. Gracefully curving across the main room was a solid railing of Botticino marble capped with a polished rail of the same material, the whole dividing the lobby from the officers' quarters. Around the room a wainscoting of marble was found while lofty pilasters of the same material with richly moulded capitals and bases of pure Doric design extended from the floor to the classic entablature which formed a rich and fitting finish to the four walls of the banking room. From the top of this entablature the walls continued upwards with a graceful cove ceiling which was sub-divided into panels by richly moulded girders and beams. The entire flat surface of the ceiling between the beams and girders was filled in with dome or ceiling sashes glazed with English cathedral glass. All of this glass was set in heavy bronze mountings in a Greek fret design and the soft amber light which was diffused throughout the banking room made it possible for the clerks to work during the greater part of the day without the use of artificial light. At the door and window openings that woodwork was finished in richly figured Cuban and Mexican mahogany forming a beautiful and striking contrast while bronze fixtures and lamp brackets surmounted by clusters of electric lights completed the ornamental effect of the spacious room. Marble brought from Italy and appropriately finished added greatly to the beauty of the rooms.

In handling the problem of remodeling, the architect, George O. Holmes, removed every vestige of the interior of the old structure, but did not touch the massive walls nor Ionic colonnades on Forsyth Street. The classic exterior of the building had been retained. In planning the banking equipment, F. Schaettler of New York City co-operated with the banking officials. The gentleman who held the general contract for the entire interior of the bank, F. Schaettler, had a large experience in this line and planned, designed and building the banking equipment of the National City Bank of New York, the largest banking institution in America. The building and grounds were carried on the books at about $275,000, a figure thought to be far below actual value.

The officers included W.D. Barnett as chairman of the board of directors, a son of the founder of the bank and a banker practically all his life. Frank Adams, a native Floridian was president. G.R. DeSaussure was active vice president. Mr. DeSaussure had spent his life in the banking business and was a close student of the banking systems of the world. He was at one time a national bank examiner. A.G. Cummer was inactive vice president and a wealthy lumberman, operating extensively in Florida and Michigan. R.E. Wheeler, cashier, worked his way up from a clerical position to the cashiership and was especially adapted to the banking business. The three assistant cashiers, all of whom worked themselves up from clerical positions, were W.R. McQuaid, C.S. L'Engle, and George A. Kirk, Jr.

The bank's statement published as of April 18, 1912, showed the Barnett National to be the largest bank in the state, a distinction it enjoyed for more than thirty years. The total resources were $7,996,367.84 with capital of $750,000, surplus and profits $535,557.55, circulation $380,000, and deposits of $6,173,023.[4]

In February 1918, Mr. Frank Adams retired from the presidency on account of ill health and was succeeded by Mr. Bion Barnett who was once before its president and had been chairman of the board for a long time.[6]

In 1921, the oldest bank in Florida was the Lewis State Bank at Tallahassee, started by B.C. Lewis before the Civil War. The second oldest bank in Florida was the Barnett National Bank of Jacksonville.[7] H.E. Harkisheimer was president of the Elgin Butter Co. and a director of the Barnett National Bank and the Peninsular Casualty Co. of Jacksonville.[8]

On April 11, 1925, Jacksonville was selected as the 1926 convention city by the Florida Bankers' Association and W.R. McQuaid, president of the Barnett National Bank of Jacksonville was elected president of the organization for the ensuing year. Other officers elected were J.H. Therrell, president of the Commercial Bank of Ocala, first vice president; W.O. Boozer, assistant vice president of the Atlantic National Bank, Jacksonville, re-elected as secretary and treasurer; J.E. Foxworthy, vice president of the Fort Myers Bank, elected chairman of the state bank section, and D.K. Catherwood, vice president of the Atlantic National Bank, Jacksonville, elected chairman of the national bank section.[9]

In 1926 the Barnett National Bank building was erected and was Jacksonville's tallest building at the time, surpassing the Heard National Bank Building. It was designed by architecture firm Mowbray & Uffinger for Barnett Bank. It remained Jacksonville's tallest building until the construction of the building later known as the Aetna Building in 1954.

On April 18, 1929, directors of the Florida National Bank and the Barnett National Bank, two of the largest banking institutions in the state, approved a plan for consolidation which would give the city a bank capitalized at approximately $45,000,000. By the terms of the merger agreement, Bion H. Barnett, chairman of the board of the Barnett bank, would become chairman of the executive committee of the institution. Arthur F. Perry, president of the Florida National, would become chairman of the board, and William R. McQuaid, president of the Barnett, would continue in the same capacity for the consolidated institution. It was understood the merger was contingent upon the passage by the legislature of an amendment to the state banking act, which would be introduced immediately, and which would provide that a bank formed by a merger in one town or city may transact business in two banking houses formerly used by the banks so uniting.[10]

On September 23, 1929, an application for a charter for a national bank at Avon Park was received by the comptroller of the currency from William R. McQuaid of Jacksonville.[11] On December 21st, the comptroller of the currency approved the charter for the Barnett National Bank of Avon Park, W.R. McQuaid, president of the Barnett National Bank of Jacksonville, advised Mayor C.S. Donalson. The bank was expected to open about January 15th according to Mr. McQuaid.[12] The Barnett National Bank of Cocoa in Brevard County had recently received a charter on October 24th, 1929.[13]

On Tuesday, October 22, 1929, Edward Ball, vice president of Almours Securities Inc., the $200,000,000 Florida corporation headed by Alfred I. DuPont with its headquarters in Jacksonville, stated plans for extensive developments in Florida. Mr. duPont became interested in Florida several years earlier with the purchase of 43,000 acres of water front property in West Florida in the vicinity of Port St. Joe, Panama City and Camp Walton. Recently the duPont organization became interested in the banking business. A controlling interest was made in the Florida National Bank of Jacksonville and the establishment of two other national banks, one at Lakeland and the other at Bartow, and application for charters for others at Daytona Beach and Orlando and contemplation of setting up still others. All of the new banks had the name Florida National and were affiliated with the Florida National in Jacksonville. Those already established had combined resources of near $25 million. Mr. duPont also held several parcels of valuable downtown property in Jacksonville and since becoming an investor in the state had erected one of the handsomest residences in Florida at San Jose facing on the St. Johns River.[14]

On January 7, 1930, J.N. Greening, assistant vice president of the Barnett National Bank of Jacksonville and a director of the Barnett National Bank of Cocoa, was named as president of the new Barnett National Bank of Avon Park. The organization of a Barnett National Bank in Avon Park gave the institution three small banks in the state, one at DeLand and one a Cocoa.[15]

In February 1930, Alfred I. duPont, whose holdings in Florida have been largely increased in the last year, takes over the presidency of the Florida National Bank and assumes actual control over the smaller Florida National outposts that have been set up in Lakeland and other cities hit by closed banks this past summer. Arthur F. Perry, former president of the Florida and an outstanding man in state banking circles, went to the Barnett National as a director and vice chairman of the board. Consolidation of banking manpower in two of the three big Jacksonville national banks would do much to increase confidence of Northern depositors in Florida banks. The consolidation also meant that in north and central Florida the bulk of financial matters would be in the hands of one of two powerful groups, either the Atlantic National Bank group or the group in which the Barnett National and the Florida National of Jacksonville had just been joined by a personal bond. An attempt was made in the legislature of 1929 to pass a law enabling the Florida and the Barnett to combine, but to occupy their existing two banking buildings. This was vetoed by national bank supervisors and the merger was dropped. With such institutions as the First National, City National, and Bank of Bay Biscayne in Miami, and the Atlantic National, Florida National and Barnett National in Jacksonville in more or less control of the banking situation along the East Coast and through the body of Florida, there was little fear of financial instability.[16]

On March 4, 1959, J. Neal Greening, prominent in Florida banking circles since 1924, died in Bradenton at the age of 62. He was president of the First National Bank of Bradenton until June 1958 when he stepped down as president on advice from doctors. Mr. Greening was vice chairman of the board of directors of the First National Bank of Bradenton. He was formerly president of the Florida National Bank in Orlando and president of the Florida National Bank in Lakeland. In December 1958, he was appointed a director of the Jacksonville branch of the Federal Reserve Bank. He came to Bradenton from Hollywood years ago to accept the presidency of the First National Bank. He at one time served as president of the Florida National Bank at Bartow and as vice-president of the Barnett National Bank in Jacksonville. He held past directorships in the Gulf State Bank at Port Richey and the First National Bank at Tarpon Springs. Mr. Greening was a native of Hustonville, Kentucky.[17] His father, Waller C. Greening, was a retired banker and organized over 50 banks throughout Kentucky and Oklahoma.[18]

Official Bank Title

1: The Barnett National Bank of Jacksonville, FL

Bank Note Types Issued

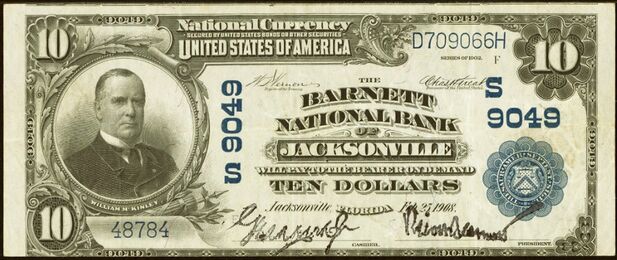

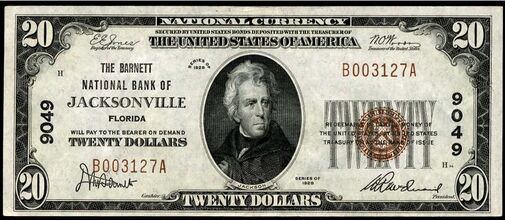

A total of $9,060,360 in National Bank Notes was issued by this bank between 1908 and 1935. This consisted of a total of 1,082,202 notes (740,076 large size and 342,126 small size notes).

This bank issued the following Types and Denominations of bank notes:

Series/Type Sheet/Denoms Serial#s Sheet Comments 1902 Red Seal 4x5 1 - 6250 1902 Red Seal 3x10-20 1 - 5000 1902 Date Back 4x5 1 - 29750 1902 Date Back 3x10-20 1 - 25000 1902 Plain Back 4x5 29751 - 101880 1902 Plain Back 3x10-20 25001 - 71889 1929 Type 1 6x5 1 - 16466 1929 Type 1 6x10 1 - 19790 1929 Type 1 6x20 1 - 5420 1929 Type 2 5 1 - 55504 1929 Type 2 10 1 - 28731 1929 Type 2 20 1 - 7835

Bank Presidents and Cashiers

Bank Presidents and Cashiers during the National Bank Note Era (1908 - 1935):

Presidents:

- Bion Hall Barnett, 1908-1909

- Hon. Frank Adams, 1910-1917

- Bion Hall Barnett, 1918-1924

- William Ravenal McQuaid, Sr., 1925-1935

Cashiers:

- George Reynolds De Saussure, 1908-1909

- Robert Emmet Wheeler, 1910-1915

- William Ravenal McQuaid, Sr., 1916-1917

- Camillus Saunders L'Engle, 1918-1922

- George Alexander Kirk, Jr., 1923-1927

- Donald Murray Barnett, 1928-1932

- Frank Wisconsin Norris, 1933-1935

Other Known Bank Note Signers

- No other known bank note signers for this bank

Bank Note History Links

- Barnett National Bank, Jacksonville, FL History (NB Lookup)

- First National Bank of Gainesville, Florida, Charter 3894 (SPMC PM#72)

- Florida Bank Note History (BNH Wiki)

Sources

- Jacksonville, FL, on Wikipedia

- YouTube Video of The Barnett Bank Building- Jacksonville’s Tallest Skyscraper 1926-1954

- Don C. Kelly, National Bank Notes, A Guide with Prices. 6th Edition (Oxford, OH: The Paper Money Institute, 2008).

- Dean Oakes and John Hickman, Standard Catalog of National Bank Notes. 2nd Edition (Iola, WI: Krause Publications, 1990).

- Banks & Bankers Historical Database (1782-1935), https://spmc.org/bank-note-history-project

- ↑ The Bankers' Magazine, Vol. 85, July-December 1912, p. 72.

- ↑ The Bankers' Magazine, Vol. 85, July-December 1912, p. 75.

- ↑ The Bankers' Magazine, Vol. 85, July-December 1912, p. 77.

- ↑ The Bankers' Magazine, Vol. 85, July-December 1912, p. 72-8.

- ↑ The Miami News, Miami, FL, Sat., Apr. 11, 1925.

- ↑ The Ocala Banner, Ocala, FL, Feb., 8, 1918.

- ↑ The Palm Beach Post, West Palm Beach, FL, Tue., Mar. 23, 1920.

- ↑ The Miami News, Miami, FL, Wed., July 13, 1921.

- ↑ Miami Tribune, Miami, FL, Sat., Apr. 11, 1925.

- ↑ The Miami News, Miami, FL, Thu., Apr. 18, 1929.

- ↑ The Palm Beach Post, West Palm Beach, FL, Tue., Sep. 24, 1929.

- ↑ The Tampa Tribune, Tampa, FL, Sun., Dec. 22, 1929.

- ↑ The Evening Tribune, Cocoa, FL, Thu., Nov. 28, 1929.

- ↑ The Stuart News, Stuart, FL, Wed., Oct. 23, 1929.

- ↑ The Evening Tribune, Cocoa, FL, Thu., Jan. 9, 1930.

- ↑ The Miami Herald, Miami, FL, Thu., Feb. 13, 1930.

- ↑ The Tampa Tribune, Tampa, FL, Thu., Mar. 5, 1959.

- ↑ The Bradenton Herald, Bradenton, FL, Thu. Jan. 5, 1967.