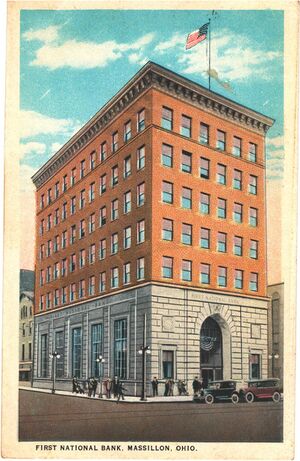

First National Bank of Massillon, OH (Charter 216)

First National Bank of Massillon, OH (Chartered 1864 - Receivership 1933)

Town History

Massillon is a city in western Stark County, Ohio, along the Tuscarawas River. Massillon is located approximately 8 miles west of Canton, 20 miles south of Akron, and 50 miles south of Cleveland. The population was 32,146 at the 2020 census. Massillon is a principal city of the Canton–Massillon metropolitan area, which includes all of Stark and Carroll counties and had a population of 401,574 in 2020. In 1860 the population was 3,819, growing to 26,400 by 1930.

The original settlement of Kendal was founded in 1812 by Thomas Rotch, a Quaker originally of New Bedford, Massachusetts, and Hartford, Connecticut. James Duncan of New Hampshire first settled in Kendal before recording the plot for Massillon on December 6, 1826. Duncan, known as the city's founder, named the town after Jean-Baptiste Massillon, a French Catholic bishop, at the request of his wife. The town plat was established along the east bank of the Tuscarawas River, which was the surveyed route for the Ohio and Erie Canal being constructed to connect Lake Erie with the Ohio River. The canal section spanning from Cleveland to Massillon was completed in 1828. Among the leading merchants were the Wellman brothers Hiram and Marshall. Marshall Wellman was the grandfather of the American author Jack London. Massillon quickly became a major port town along the canal route, known as the Port of Massillon, following the canal's completion in the 1832. The first telegraph lines would reach Massillon in 1847, and the Ohio & Pennsylvania Railroad would extend its rails to Massillon in 1852. Massillon incorporated as a village in 1853. In 1868, Massillon incorporated as a city when the populated reached 5,000.

Massillon had four National Banks chartered during the Bank Note Era, and three of those banks issued National Bank Notes.

Bank History

- Chartered January 25, 1864

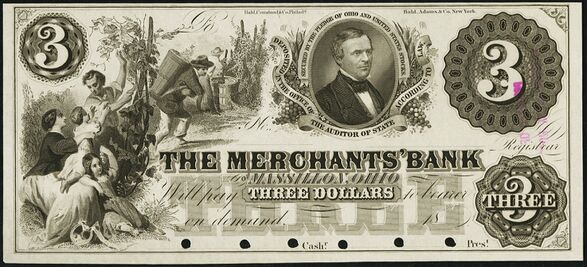

- Succeeded Merchants Bank of Massillon

- Absorbed 1318 November 4, 1931 (Union National Bank, Massillon, OH)

- Conservatorship March 14, 1933

- Receivership May 23, 1933

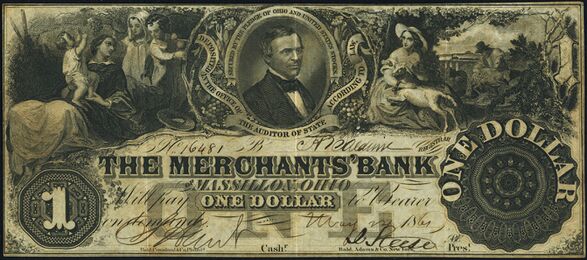

The Merchants Bank of Massillon was organized under the Free Banking Law of March 21, 1851. It opened on July 1, 1851, and was located on the east side of Erie Street between Main and Charles Streets, across the street from the Union Branch of the State Bank of Ohio. It became the First National Bank of Massillon (Charter 216) on January 8, 1864, leaving $9,000 in outstanding state bank circulation in 1868 when the bond securing the bank's state circulation was released to the former shareholders.

The Merchants' Bank of Massillon was fully organized under the free banking law passed last winter and will go into full operation in a few days. This was the third institution of the kind organized in Ohio under the new law.[1] The bank commenced operations on July 1st, 1851, with I. Steese, president; and S. Hunt, cashier.[2] Dr. Isaac Steese was the former president of the Union Bank and S. Hunt was formerly the cashier of the Bank of Massillon.[3] In December 1851, new banks in Ohio were Pickaway County Bank at Circleville, Stark County Bank at Canton, Iron Bank of Ironton, Merchants' Bank of Massillon, Springfield Bank, Forest City Bank of Cleveland, Union Bank at Sandusky City, The Miami Valley Bank at Dayton, The Bank of Commerce, Cleveland, Bank of Marion, Champaign County Bank at Urbana, and Saving Bank of Cincinnati.[4]

On May 9, 1871, at the annual election of officers of the First National Bank, Isaac Steese, George Harsh, S. Hunt, Charles Steese, John Jacobs, Arvine C. Wales, and Jacob L. Bachtel were elected directors. At a meeting of the directors on the same day, Dr. Isaac Steese was elected president, J. Hunt, cashier; and Charles Steese, assistant cashier.[5]

On Monday morning, August 10, 1874, Dr. Isaac Steese died at his residence on Prospect Street in Massillon at the age of sixty-five years. At the time of his decease he was President of the First National Bank, having been with J. Hunt, Esq., Cashier, its founder, as he also was of the Merchants' Bank, of which the First National was the successor. For more than twenty-five years he was identified with Massillon interests and enterprises, not one of which did he ever allow to suffer. There are few men who could have been taken out of the business and social circles that will be missed as will Dr. Steese. He leaves a wife, two sons and & daughter: Charles Steese, Esq., assistant cashier First National Bank; Dr. Edward Steese of the house of McJunes & Co., Boston, Mass.; and Miss Anna, all of whom were with their father during his lingering illness.[6]

On Saturday, March 12, 1892, Salmon Hunt, president of the First National Bank and one the oldest residents most highly esteemed citizens of this city, died at 9 o'clock p.m. He was 79 years of age. He has been identified with the banking interests of the city for more than half a century and was the recognized leader of the "free thought" people in this section of Ohio. He left a son, James H. Hunt, who was cashier of the Union National Bank.[7]

In January 1893, the officers were Charles Steese, president; George Harsh, vice president; J.M. Schuckers, cashier; C. Steese, George Harsh, John Jacobs, D. Atwater, and J.M. Schuckers, directors.[8]

Early Wednesday morning, March 12, 1902, John Jacobs, one of the oldest and most respected citizens of Massillon, vice president of the First National Bank and owner and projector of some of the largest business interest in this vicinity, died at his residence. Mr. Jacobs was born in Franklin County, Pennsylvania, April 15, 1812. As an orphan, he came to Ohio on foot in the Spring of 1857, securing employment in a warehouse. Later he purchased the Acadia, a canal boat of which he became captain, running between Massillon and Cleveland the journey taking four days. He would become one of the most extensive coal miners and dealers of Stark County and owned hundreds of acres of the most valuable coal lands. He was one of the organizers of the First National Bank and a director at the time of his death.[9]

The Report of Condition as of the close of business on December 31, 1930, showed total resources of $3,918,105.83, with Capital stock paid in $800,000, Surplus $150,000, undivided profits $16,199.61, circulation $300,000, and total deposits $3,040,998.26. W.A. Krenrick was cashier and the directors attesting to the correctness of the report were P.L. Hunt, Chas. D. Yost, and J.B. Immler.[10]

On Tuesday, January 13, 1931, all officers and directors of the First National Bank and the Union National Bank were reelected during annual meetings of stockholders and boards of directors of the two financial institutions. Per Lee Hunt was re-elected president of the First National Bank and J.H. Hunt was renamed president of the Union National Bank. At the meeting of the stockholders of the First National, Per Lee Hunt, John E. McLain, Blaine Zuver, Charles D. Yost, W.H. Crawford, Joseph B. Immler, William A. Krenrick, and M.P.L. Kirchhofer were re-elected directors. The directors then re-elected Mr. Hunt, president; John E. McLain, chairman of the board; Blaine Zuver, vice president; William A. Krenrick, cashier and Albert J. Albright, assistant cashier. At the Union National, J.H. Hunt, R.R. Hess, H.T. Beatty, H.L. McLain, J.G. Lester, and Martin Brenner were re-elected directors. The directors re-elected Mr. Hunt president; H.T. Beatty vice president; H.L. McLain, cashier; and J.G. Lester, cashier. A good year with a normal profit was reported at the meeting.[11] The report omitted three directors of the Union National Bank; they were Charles B. Silk, William G. Clementz, and H.F. Dielhenn.[12] On Monday, September 28, 1931, consolidation of the First National Bank and the Union National Bank was announced by officials of both banks after the directors approved the plan. The consolidation, effective on Tuesday, would give Massillon one of the strongest financial institutions in Stark County. Both banks had been in existence for more than 80 years. The affairs of the consolidated banks would be conducted in the headquarters of the First National.[13] Stockholders of the Union National Bank met on November 4th at the banking rooms, 118 Lincoln Way, E. Massillon, to vote on the voluntary liquidation of the bank and ratifying the agreement of September 28th relating to the transfer of assets.[14]

Conservator Appointed

On Thursday evening, April 20, 1933, a meeting of approximately 400 depositors of the First National Bank was held in city hall auditorium. Depositors authorized a committee of 12 members, eight men and four women, be appointed by and include E.A. Neutzenholzer as chairman of the depositors committee, to work with the conservator. The action was taken after E.A. Campbell of Philadelphia, conservator of the bank, explained the plan for reopening of the bank and tell how John Jacobs came to the rescue of Massillon by providing $150,000 in new cash capital to make the reopening possible. Before the meeting ended, Mr. Neutzenholzer called upon the audience for any suggestions, criticisms or questions. When there was none forthcoming, he urged the depositors to air their opinions at the meeting and not on the street corners but even then there were only two questions dealing with the new bank. Not one dissenting voice was raised during the meeting, all the depositors expressing unanimous approval of the plan and the appointment of the committee to represent them. In explaining how liquidation of assets of the old bank could be accomplished, Mr. Campbell pointed out that there were two methods available: first, appointment of a receiver at considerable expense to depositors, or second, appointment of a trustee who would work in conjunction with the new bank in liquidating assets of the old. The bank, Mr. Campbell told his audience, belongs to the depositors and whether 30% or 40% of their deposits was tied up and, he said, Mr. Jacobs was fighting to have 70 percent released, depended on the method followed. "It is your money," he emphasized, "that is in jeopardy". Mr. Campbell expressed the opinion that the depositors wanted to avoid absolute receivership, but stated that a bank which is insolvent should go into the hands of a receiver.

Appointment of a receiver, the conservator said, would result in the expenses connected with his clerical force, headquarters, appointment of a manager if he was to manage the bank building and other items, all of which would bring less returns to the depositors. It also would mean that an appraisal of all loans would be made public property and that it would be difficult to collect the entire amounts borrowed if borrowers were to learn that the appraisals of their loans were less than amounts borrowed.

Trustee Recommended He suggested that this expense and inconvenience be avoided and that a trustee be named to work with the new bank. A plan had been suggested, to William Taylor, of Cleveland, chief bank examiner of the fourth district, whereby the new bank would act as trustee for liquidation of assets of the old bank and the new bank agreed to collect the loans for a fee of six percent interest on the amount of the dead assets. Mr. Campbell stated that Mr. Jacobs wanted to learn what the depositors wanted done including any suggestions as to members of the board of directors of the new bank. Present members of the board, he said, had been asked to serve as trustees tentatively. A board is wanted, he declared, which will not make loans to officers or directors without sufficient security, not speculate in stocks and not make anything but business loans. In addition to the help he had given the First National Bank, Mr. Jacobs, Mr. Campbell stated, was ready to help the State Bank of Massillon if given the opportunity. Mr. Jacobs, the conservator said, also had ordered him to get two local industries started. Mr. Campbell stated that he had been working with the chamber of commerce since January in this direction. "If the new bank and the other bank in town are properly supported, both will be in fine shape in a year," according to Mr. Campbell. Mr. Jacobs said he would put up the money necessary so it would not cost the city anything.

Sometime ago, the Union National Bank was in a bad condition and it was necessary for it to write off a considerable amount of loans as ordered by the bank examiner. Directors and officers of the bank were called because it was their responsibility to put up the money wo which the bad loans would be charged. They were unable to put up sufficient money, so they applied to Mr. Jacobs and he put up the cash. At that time the Union National Bank had been taken over by the First National and with it its securities and other assets. In looking over some of the assets, Mr. Jacobs stated they were rotten investments and ordered that they be sold immediately. At that time, Mr. Jacobs also criticized some of the First National's own investments and loans. In October 1932, bank examiner Taylor sent his best man into the bank and the examination found there was mismanagement and the operation of the bank was rotten and ordered more changes. The management had failed to sell any of the securities previously criticized. At that time Mr. Jacobs declared that he would not see the First National closed but would not let things go on as they were. He offered to take over the control of the bank if he was permitted to send in Mr. Campbell. The board turned the management over to Mr. Campbell and he learned that close to 90% of its loans were laying dormant and that the depositors' money was being jeopardized. He then brought in Lee A. Laubenstein, specialist on collecting loans. Mr. Laubenstein came on January 1st and by March 1st, more than 95% of the loans were under curtailment. When he came there were 75 delinquent loans and on March 1st there were only four. Unfortunately, at that time the bank holiday was declared and the new emergency banking act passed. The Government was looking out for the depositors and a bank had to show that it was safe before receiving a license to reopen. Under ordinary circumstances, a bank is safe if from 30 to 30 percent of its assets are liquid, in cash or good bonds which would be converted into cash in a short time. The local bank was not in that shape. Government agents came in and analyzed loans, and their values were listed at what they were worth. The bank had a certain amount of other assets including the bank building which already was mortgaged for $200,000, the amount it was worth. The assets were not enough to warrant the bank receiving a license.

With that situation a plan of reopening had been worked out at a conference at Pittsburgh and would result in the reopening of the bank within 30 days. Mr. Neutzenholzer assumed the chairmanship of the committee of depositors which had been functioning for a couple of weeks. Commenting on the banking situations in Akron and Cleveland, Mr. Neutzenholzer pointed out that neither of those cities had a public-spirited citizen like Mr. Jacobs to come to their rescue like the former local man had come to Massillon's recue. The situation required drastic, quick and positive action to get the bank open, Mr. Neutzenholzer stated. The First National was the first bank in the district to have a complete audit of its books.[15]

First National Bank at Massillon (Charter 13687) (No Issue)

- Organized May 10, 1933

- Chartered May 18, 1933

- 1: First National Bank at Massillon (Non-issuing)

- 2: First National Bank in Massillon (Non-issuing) (7/14/1933)

- For Bank History after 1935 see: FDIC Bank History website

- Notation on Organization Report: Non-issuing, succeeded The First National Bank of Massillon (Charter 216)

On Thursday, May 18, 1933, the new First National Bank at Massillon (No. 13687) opened for business, succeeding the old First National that had been in existence since 1848. Just 63 days after the appointment of a conservator, the new institution with new cash and staff of officers entered upon its business career. With the opening $1,500,000 was made available to depositors of the old bank, bringing the total freed to 65%. The remaining 35% was expect to be released during the coming year or 18 months. The charter was brought by airplane from Washington by E.A. Neutzenholzer, chairman of the depositors committee who with Kenneth Cope of Canton, the bank's attorney and Attorney C.W. Portmann, a member of the stockholders committee, had spent the past week at the capital steering negotiations through labyrinthian recesses of the Treasury Department. With Mr. John Jacobs as chairman, the board consisted of E.A. Campbell, A.A. Hammersmith, Dr. G.C. Gottshall, Blaine Zuver, W.S. Wenger, and E.A. Neutzenholzer of Massillon and H.S. Parrish of Brewster. The officers were E.A. Campbell, president; Blaine Zuver, vice president; Lee A. Laubenstein, cashier; Howard M. Dehoff, assistant cashier; William Wenger, secretary; J.A. Putman, new business manager; W.L. Kerstetter, in charge of commercial accounts; Mrs. Mabel Johns in charge of the savings and certificate of deposit department; Stanley Switter in charge of safety deposit boxes and vault. The reopening plan called for the appointment of H. Ross Ake of Canton, regional receiver for the Treasury Dept. as receiver for the slow and frozen assets of the old bank and A.J. Albright as assistant receiver. Mr. Albright also would act as superintendent of the bank building.[17]

On September 1, 1933, E.A. Campbell, president of the First National Bank at Massillon, confirmed reports to the effect that a new institution might be opened in Akron about December 15th. On behalf of John Jacobs of Philadelphia, formerly of Massillon, millionaire manufacturer and financier and chairman of the board of the local First National, Mr. Campbell said that entry into the Akron financial field was being seriously considered. "Mr. Jacobs has told me many times that he desired not only to lend what aid he could to his native city of Massillon, but that he was ready to do anything he could for the state of Ohio. All that he has done and is doing has been and is being done with the knowledge and cooperation of the U.S> Treasury Department and the RFC." Jacobs had wide banking connections and interests and Campbell had been identified with the banking business for many years. Jacobs had lived in Philadelphia for more than 20 years, but when the bank crisis developed, came to the aid of his native city.[18]

On Tuesday, January 8, 1935, John Jacobs was re-elected chairman of the board and Blaine Zuver, president of the First National Bank in Massillon at the annual meeting of stockholders. Other officers chosen were Grant D. Esterling, executive vice president and cashier; P.L. Hunt, vice president; H.L. Dehoff, assistant cashier; and A.J. Albright, auditor and building manager. Ralph H. Maxson of the Tyson Roller Bearing Co. and Mr. Esterling were added to the board of directors. Other directors selected were Mr. Jacobs, Mr. Zuver, A.A. Hammersmith, P.J. Bordner and Henry S. Parrish.[19]

In May 1936, E.A. Campbell, former president of the First National Bank would be tried in the fall on a charge of accepting $4,500 in commission on a $50,000 loan to the India Tire and Rubber Co. of Akron. Campbell was acquitted May 14 of a charge of misapplication of bank funds.[20] On Monday, September 14th, he was tried on the second charge in federal court, Cleveland.[21] The jury was given the case Tuesday afternoon in Federal Judge Samuel H. West's court. When it failed to reach a decision by evening, the jury was dismissed for the night and resumed deliberations in the morning.[22]

Less than four years ago, Edward A. Campbell came to Massillon from Philadelphia in what was accepted as the role of savior of the old First National Bank, which, like many banks at the time, was feeling the effects of depression. Mr. Campbell made promises of adequate financial support for the institution. He was given honors by and the confidence of the citizens. He entered enthusiastically into civic and business affairs. He provided money freely to advertise the city and assist worthy causes. After the bank was closed by presidential decree, he worked night and day to organize a new bank. In a little over two months the new institution, was functioning. He concentrated efforts to liquidate many accounts of the old bank. He extended his activities to Akron and operated an armored money truck between the two cities. With Akron hard hit by bank closings, he sought to make Massillon the money center of the rubber city. His career here was marked by spectacular feats, performed and attempted. He was the chief topic of conversation in many quarters. He had a way of making staunch friends and bitter enemies. He was both admired and hated. And then, suddenly, he went out like a light. The career upon which he launched himself in Massillon less than four years ago came to an end, Wednesday, in Cleveland, when Mr. Campbell was found guilty on five counts by a jury in United States District Court, sentenced by the judge to four months in the federal reformatory in Milan, Michigan, and fined $3,000 and costs. Judge West declared the verdict justifiable. He excoriated Campbell from the bench, accusing him of having practiced extortion on a helpless customer. He told him he had violated the law and profited from the violation. He spared Campbell the maximum sentence only because he said he had not been in trouble before. Thus ended a dazzling chapter of finance in Massillon. Rarely does such an opportunity for civic service come to a man as came to Mr. Campbell, in Massillon. The court record shows, what he did with it.[23][24]

On November 6, 1974, John Jacobs, 82, of 3750 Galt Ocean Dr., Fort Lauderdale, died at his residence. He was a 30-year resident from Philadelphia.[25] Mr. Jacobs was born in Massillon, Ohio, on August 1, 1892, the son of Warren and Emma C. Jacobs. He was the grandson of John Jacobs, a pioneer Stark County coal operator and former vice president of the First National Bank of Massillon.

- 10/18/1976 Main Office moved to One First National Plaza, Massillon, OH 44646.

- 03/21/1989 Reorganized banking operations.

- 01/31/1995 Changed Institution Name to Citizens National Bank.

- 01/31/1995 Main Office moved to 100 Central Plaza South, Canton, OH 44702.

- 01/31/1995 Acquired Citizens Savings Bank of Canton (FDIC #28350) in Canton, OH.

- 03/23/1998 Merged and became part of Firstmerit Bank, National Association (FDIC #13675) in Akron, OH.

- 08/16/2016 Merged and became part of The Huntington National Bank (Charter 7745) (FDIC #6560) in Columbus, OH.

Official Bank Title

1: The First National Bank of Massillon, OH

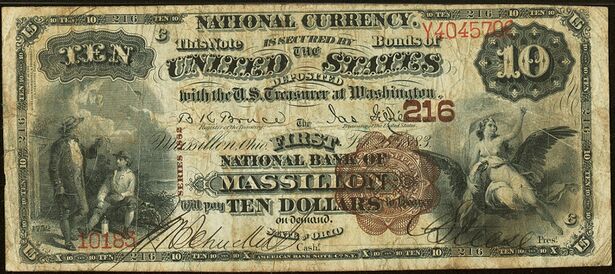

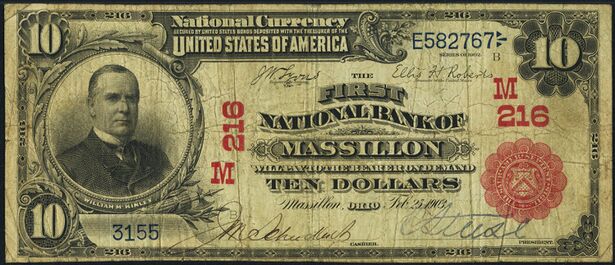

Bank Note Types Issued

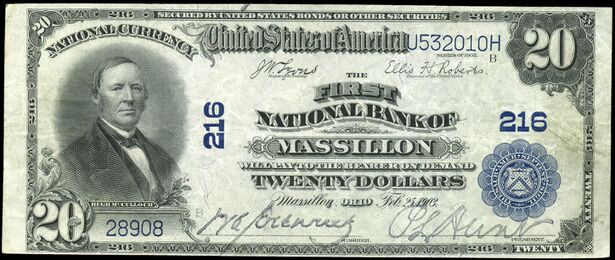

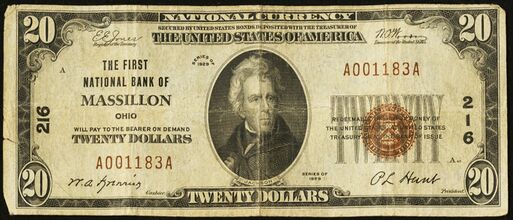

A total of $5,108,140 in National Bank Notes was issued by this bank between 1864 and 1933. This consisted of a total of 471,000 notes (411,132 large size and 59,868 small size notes).

This bank issued the following Types and Denominations of bank notes:

Series/Type Sheet/Denoms Serial#s Sheet Comments Original Series 4x5 1 - 7000 Original Series 4x10 1 - 4500 Original Series 2x20-50-100 1 - 405 Series 1875 4x5 1 - 4750 Series 1875 4x10 1 - 2875 Series 1875 2x20-50-100 1 - 220 1882 Brown Back 3x10-20 1 - 10780 1902 Red Seal 3x10-20 1 - 7000 1902 Date Back 3x10-20 1 - 9700 1902 Plain Back 4x5 1 - 14000 1902 Plain Back 3x10-20 9701 - 51253 1929 Type 1 6x10 1 - 7827 1929 Type 1 6x20 1 - 2151

Bank Presidents and Cashiers

Bank Presidents and Cashiers during the National Bank Note Era (1864 - 1933):

Presidents:

- Dr. Isaac Steese, 1864-1873

- Salmon Hunt, 1874-1892

- Charles Steese, 1893-1915

- Per Lee Hunt, 1916-1932

Cashiers:

- Salmon Hunt, 1864-1873

- Charles Steese, 1874-1891

- J. Melville Schuckers, 1892-1913

- Per Lee Hunt, 1914-1915

- William Andrew Krenrick, 1916-1932

Other Known Bank Note Signers

- No other known bank note signers for this bank

Bank Note History Links

Sources

- Massillon, OH, on Wikipedia

- Don C. Kelly, National Bank Notes, A Guide with Prices. 6th Edition (Oxford, OH: The Paper Money Institute, 2008).

- Dean Oakes and John Hickman, Standard Catalog of National Bank Notes. 2nd Edition (Iola, WI: Krause Publications, 1990).

- Banks & Bankers Historical Database (1782-1935), https://spmc.org/bank-note-history-project

- ↑ The Pittsburgh Post, Pittsburgh, PA, Thu., June 5, 1851.

- ↑ Pittsburgh Post-Gazette, Pittsburgh, PA, Fri., July 4, 1851.

- ↑ The Marysville Tribune, Marysville, OH, Tue., June 3, 1851.

- ↑ The Marysville Tribune, Marysville, OH, Tue., Dec. 2, 1851.

- ↑ The Stark County Democrat, Canton, OH, Thu., May 11, 1871.

- ↑ The Stark County Democrat, Canton, OH, Thu., Aug. 13, 1874.

- ↑ The Stark County Democrat, Canton, OH, Thu., Mar. 17, 1892.

- ↑ The Cleveland Press, Cleveland, OH, Wed., Jan. 11, 1893.

- ↑ The Cleveland Press, Cleveland, OH, Wed., Mar. 12, 1902.

- ↑ The Independent, Massillon, OH, Wed., Jan. 7, 1931.

- ↑ The Independent, Massillon, OH, Wed., Jan. 14, 1931.

- ↑ The Independent, Massillon, OH, Thu., Jan. 15, 1931.

- ↑ The Newark Advocate, Newark, OH, Mon., Sep. 28, 1931.

- ↑ The Independent, Massillon, OH, Fri., Oct. 2, 1931.

- ↑ The Independent, Massillon, OH, Fri., Apr. 21, 1933.

- ↑ The Independent, Massillon, OH, Thu., May 18, 1933.

- ↑ The Independent, Massillon, OH, Thu., May 18, 1933.

- ↑ The Independent, Massillon, OH, Fri., Sep. 1, 1933.

- ↑ The Independent, Massillon, OH, Thu., Jan. 10, 1935.

- ↑ The Independent, Massillon, OH, Fri., June 5, 1936.

- ↑ The Independent, Massillon, OH, Mon., Sep 14, 1936.

- ↑ The Independent, Massillon, OH, Wed., Sep. 16, 1936.

- ↑ The Independent, Massillon, OH, Fri., Sep 18, 1936.

- ↑ Lancaster Eagle-Gazette, Lancaster, OH, Thu., Sep. 17, 1936.

- ↑ Fort Lauderdale News, Fort Lauderdale, FL, Thu., Nov 7, 1974.