Seaboard National Bank/Seaboard Citizens NB, Norfolk, VA (Charter 10194)

Seaboard National Bank/Seaboard Citizens NB, Norfolk, VA (Chartered 1912 - Open past 1935)

Town History

Norfolk (/ˈnɔːrfʊk/ ⓘ NOR-fuk) is an independent city in Virginia. As of the 2020 census, Norfolk had a population of 238,005, making it the third-most populous city in Virginia after neighboring Virginia Beach and Chesapeake, and the 95th-most populous city in the nation. Norfolk holds a strategic position as the historical, urban, financial, and cultural center of the Hampton Roads region (sometimes called "Tidewater"), which has more than 1.8 million inhabitants and is the 37th-largest metropolitan area in the U.S., with ten cities.

In 1634 King Charles I reorganized the Virginia Colony into a system of shires, and Elizabeth Cittie became Elizabeth City Shire. After persuading 105 people to settle in the colony, Adam Thoroughgood (who had immigrated to Virginia in 1622 from King's Lynn, Norfolk, England) was granted a large land holding, through the head rights system, along the Lynnhaven River in 1636. When the South Hampton Roads portion of the shire was separated, Thoroughgood suggested the name of his birthplace for the newly formed New Norfolk County. One year later, it was divided into two counties, Upper Norfolk and Lower Norfolk (the latter now incorporated into the City of Norfolk), chiefly on Thoroughgood's recommendation.

Norfolk was incorporated in 1705. Bordered to the west by the Elizabeth River and to the north by the Chesapeake Bay, the city shares land borders with the independent cities of Chesapeake to its south and Virginia Beach to its east. With coastline along multiple bodies of water, Norfolk has many miles of riverfront and bayfront property, including beaches on the Chesapeake Bay. The coastal zones are important for the economy. The largest naval base in the world, Naval Station Norfolk, is located in Norfolk along with one of NATO's two Strategic Command headquarters. Additionally, Norfolk is an important contributor to the Port of Virginia. It is home to Maersk Line, Limited, which manages the world's largest fleet of US-flag vessels. This low-lying coastal infrastructure is very vulnerable to sea level rise, with water levels expected to rise by more than 5.5 feet by the end of the 21st century.

The city has a long history as a strategic military and transportation point, where many railroad lines started. It is linked to its neighbors by an extensive network of interstate highways, bridges, tunnels, and three bridge-tunnel complexes. The Norfolk Naval Shipyard, often called the Norfolk Navy Yard and abbreviated as NNSY, is a U.S. Navy facility in Portsmouth, Virginia, for building, remodeling and repairing the Navy's ships. It is the oldest and largest industrial facility that belongs to the U.S. Navy as well as the most comprehensive. Located on the Elizabeth River, the yard is just a short distance upriver from its mouth at Hampton Roads.

Norfolk had 10 National Banks chartered during the Bank Note Era, and eight of those banks issued National Bank Notes.

Bank History

- Organized May 1, 1912

- Chartered May 13, 1912

- Conversion of Seaboard Bank of Norfolk

- 1: Assumed 12151 by consolidation May 6, 1922 (Continental NB (No Issue), Norfolk, VA)

- 1: Assumed The Citizens Bank of Norfolk by consolidation June 30, 1928, with title change

- Bank was Open past 1935

The Atlantic Trust and Deposit Company was chartered in February 1902 with $50,000 capital and $50,000 surplus, and Mr. R.M. Hughes, president.[4] In November 1903, A.E. Krise was elected president as successor to Floyd Hughes, resigned.[5]

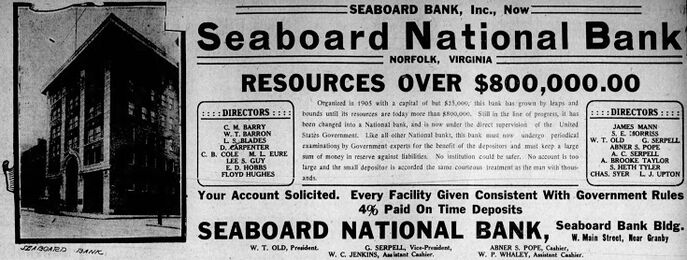

The Seaboard Bank was organized in 1905 with a capitalization of $100,000 in the Board of Trade building at Plume and Atlantic Streets. The officers were M.L. Eure, president; J.A. Ridgewell, J.L. Camp, and W.W. Zachary, vice presidents; Thos. J. Powell, cashier; and Geo. B. Crow, assistant cashier.[6]

In March 1908, the Atlantic Trust & Deposit Company decided to retire from the general banking business and would devote all of its energies in the bonding and trust business. By taking over the general banking business of the Atlantic Trust and Deposit Co., the Seaboard Bank had increased its resources to $600,000 while the trust company had $250,000 capital and $80,000 surplus with which to engage exclusively in a bonding and trust business. The Seaboard Bank would occupy the commodious offices of the Atlantic Trust & Deposit Company.[7]

On Tuesday, January 11, 1910, the stockholders of the Seaboard Bank re-elected the board of directors and added W.T. Barron to the directorate. The officers of the bank were G. Serpell, president; Abner S. Pope, vice president; W.C. Jenkins, cashier; and the directors including the officers above were D.B. Amers, T.M. Bellamy, D. Carpenter, C.B. Cole, M.L. Eure, D.H. Goodman, Lee S. Guy, W.H. Hampton, Floyd Hughes, James Mann, S.E. Morriss, Arthur J. Odell, G.M. Serpell, A. Brooke Taylor, S. Heth Tyler, L.J. Upton, and W.T. Barron.[8]

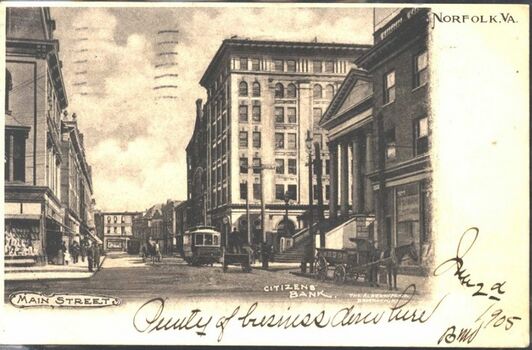

In 1912, the Seaboard reorganized as a national bank. The officers were W.T. Old, president; G. Serpell, vice president; Abner S. Pope, cashier; W.C. Jenkins and W.P. Whaley, assistant cashiers. Directors were C.M. Barry, W.T. Barron, L.S. Blades, D. Carpenter, C.B. Cole, M.L. Eure, Lee S. Guy, E.D. Hobbs, Floyd Hughes, James Mann, S.E. Morriss, W.T. Old, G. Serpell, Abner S. Pope, A.C. Serpell, A. Brooke Taylor, S. Heth Tyler, Chas. Syer, and L.J. Upton. The bank was located at No. 111 W. Main Street, near Granby.[9]

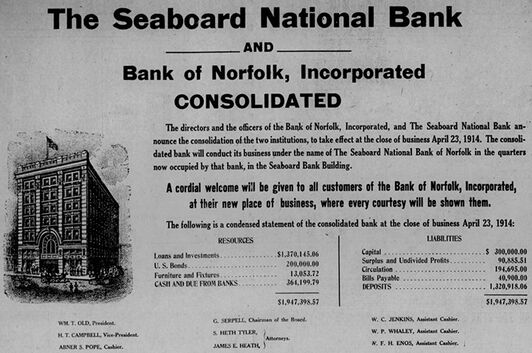

At the close of business on April 23, 1914, the consolidation of the Bank of Norfolk, Incorporated, and The Seaboard National Bank, would take effect. The consolidated bank would conduct its business under the name of The Seaboard National Bank of Norfolk in the quarters occupied by that bank in the Seaboard Bank Building. The consolidated bank had total resources of $1,947,398.57, with capital $300,000, surplus and undivided profits $90,885.51, circulation $194,695, and deposits $1,320,918.06. Wm. T. Old was president; G. Serpell, chairman of the board; H.T. Campbell, vice president; Abner S. Pope, cashier; W.C. Jenkins, W.P. Whaley, and W.F.H. Enos, assistant cashiers; S. Heth Tyler and James E. Heath, attorneys.[10]

The afternoon of Wednesday, January 15, 1919, the following officers were elected: W.T. Old, president; H.T. Campbell, vice president; J.B. Moss, vice president and cashier; Roy Dudley, assistant cashier; T.A. Bain, auditor; and S. Heth Tyler, attorney.[11]

In January 1922, directors of the Continental Trust Company elected at the annual meeting would all be men who had previous service on the board. The list included William Sloane, F.E. Rogers, Joseph A. Wallace, A.J. Truitt, Dr., J.A. Norfleet, B.J. Thompson, T.H. Synon, John Eberwine, C.D. Colonna, C.M. Williamson, E.M. Baum, H.B. Calwell, T. Gray Coburn, George W. Wey, A. E. Ewell, Ralph Fensterwald, Robert Hasler, Floyd Hughes, Arthur P. Jones, Dr. J. Jett McCormick, E.W. McGann, Jr., J.B. Morgan, E.J. Robertson, Charles Syer, L.J. Upton, R. Frank Welton, Abner S. Pope, W.B. Dougherty, E.W. Benard, and S.W. McGann. Directors of the Seaboard National made no changes. The list included Goldsborough Serpell, chairman of the board; W.T. Olds, president; H.T. Campbell and James B. Moss, vice presidents; R.W. Dudley, cashier; T.A. Bain, assistant cashier and R.P. Wingfield, auditor.[12] The stockholders of the Continental Trust Company located at 159 Granby Street, Norfolk, met on Tuesday, March 21, 1922, and approved the conversion of the trust company into a National Banking Association. The conversion was a preliminary step to the consolidation with the Seaboard National Bank.[13] Stockholders of the Seaboard National Bank at a meeting held March 29, 1922, ratified the contract entered into by its directors providing for a consolidation with the Continental National Bank of Norfolk under the charter and name of the Seaboard National Bank of Norfolk.[14] The former home of the Continental Trust Company, corner of City Hall Avenue and Granby Street, was occupied by the City Bank and Trust Company. A portion of that building had been remodeled for a small store, the remainder of the first floor for banking rooms.[15] On Monday, May 8, 1922, W.V. Capps of the Seaboard National returned from Washington and brought with him the certificate of consolidation issued by the comptroller of the currency on the merger of the Continental Trust Company with the Seaboard.[16]

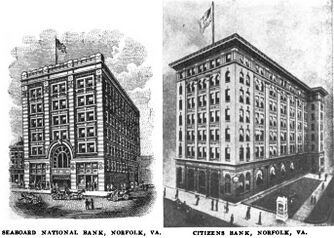

On Tuesday, May 29, 1928, board of the Citizens Bank and the Seaboard National Bank approved plans to consolidate the two banks. Special meetings of the stockholders of both institutions were called from June 27 to vote on ratification of the plan. The consolidated bank would be known as the Seaboard Citizens National Bank and eventually be in the Citizens Bank quarters after the quarters were enlarged to accommodate all activities. Goldsborough Serpell, president of the Seaboard National, would be chairman of the board of the new bank, while Norman Bell, president of the Citizens Bank would be the president. After consolidation the new institution would have $2,000,000 of capital stock, surplus and undivided profits of approximately $1,500,000, and total resources of about $21,000,000. Issuance of stock in the new institution would be on a share for share basis. Resources of the Seaboard National were a little over $12 million while the Citizens Bank resources were $9 million. Merger of the two banks had been under consideration for months and came to a head recently when directors of both institutions tentatively agreed on the consolidation. Bank examiners had recently finished examination of the two banks, submitted their report to the comptroller of the currency, and the later issued authority for the merger, setting forth the basis on which it could be accomplished.

The Citizens Bank was the oldest commercial bank in Norfolk having been chartered in 1867. Under the new Federal banking law, it was not necessary for such a bank to receive a national charter before being consolidated with a national bank. The Seaboard National was organized in January 1905 with a capital of $100,000. Since that time it had absorbed in order the Atlantic Trust and Deposit Company, the Bank of Norfolk, and the Continental Trust Company, to become second in size among Norfolk banks. Merger of the National Bank of Commerce Norfolk National Bank, and the Trust Company of Norfolk about 18 months ago was the largest transaction of its kind in local financial history.

Plans for the enlargement of the Citizens Bank quarters were only in a tentative state. It was proposed to acquire property adjoining the Citizens Bank on the east to enable the institution to spread at least its first floor facilities in that direction. Final disposition of the Seaboard National Bank quarters had not been determined. The latter was operated on the ground floor of a six-floor office building while the Citizens Bank was an eight-floor office building.

Directors of the Seaboard National Bank, all of whom would be on the board of the new bank were: D.B. Ames, P.D. Bain, C.M. Barry, D. Carpenter, R.I. Cheatham, James W. Derrickson, R.W. Dudley, John G. Eberwine, O.J. Egerton, Z.V. Eure, A.E. Ewell, M.S. Hawkins, C.H. Hix, Arthur P. Jones, J. Jett McCormick, W.T. Old, E.L. Parker, Abner S. Pope, E.J. Robertson, A.C. Serpell, G. Serpell, William Sloane, Charles Syer, A.J. Truitt, S. Heth Tyler, Joseph A. Wallace, and George F. Wilkinson.

The Citizens Bank directors, all of whom also would sit on the new board were: Norman Bell, John I. Clarke, Robert B. Cooke, R. Bolling Cooke, Joseph W. DeJarnette, E.G. Dodson, Willis N. Gregory, E.E. Holland, J. Bilisoly Hudgins, John S. Jenkins, William M. Jones, D.W. Jordan, Louis Mansbach, Amedeo Obici, W.L. Prieur, Jr., E.S. Ruffin, Jr., Aaron B. Seldner, Otto Wells, Robert H.B. Welton, W. Leigh Williams,[18] and Wm. G. Swartz.

Planters Peanuts was founded by Italian immigrant Amedeo Obici in Wilkes-Barre, Pennsylvania. By 1913, Obici had moved to Suffolk, Virginia, the peanut capital of the world, and opened the company's first mass production plant and facility there. It was acquired by Standard Brands in 1960. In 1981, Standard Brands merged with Nabisco Brands, which was acquired by Kraft Foods in 2000.

Stockholders ratified the agreements for the consolidation of the two institutions under the name of the Seaboard Citizens National Bank, effective Monday, July 2d, 1928.[19] The executive staff of the Seaboard Citizens National Bank was as follows: Goldsborough Serpell, chairman of the board; Norman Bell, president; William Sloane, W. Leigh Williams, Abner S. Pope, Davis W. Jordan, vice presidents; R.W. Dudley, vice president and cashier; E.W. Berard, M.B. Langhorne, S.W. McGann, R.W. Porter (manager of the Berkley branch), R.P. Wingfield, assistant cashiers; L.W. Mitchell, auditor; E. Griffith Dodson, manager, trust department; Thomas A. Bain, manager, bond department.[20]

On Wednesday, May 25, 1932, directors of the Seaboard Citizens National Bank elected Abner S. Pope, one of the best known bankers in Norfolk, president to succeed Norman Bell whose death occurred Sunday. Roy W. Dudley, vice president and cashier, was promoted to executive vice president and E.G. Dodson, trust officer, was made vice president and trust officer. E.W. Berard, assistant cashier, was advanced to the position of cashier. The official staff of the bank also included W. Leigh Williams, vice president; Goldsborough Serpell, chariman of the board; J. Bilisoly Hudgins, vice president M.G. Longhorne, R.W. Porter, S.W. McGunn, and L.W. Mitchell, assistant cashier; T.A. Bain, manager of Trust Dept. Mr. Porter was in charge of the Berkley Branch.[23]

Goldsborough Serpell II was born in Connellsville, Pennsylvania, July 15, 1875. His father, Goldsborough McDowell Serpell I worked as a civil engineer for the Louisville & Nashville Railroad and the Baltimore & Ohio Railroad. Goldsborough Serpell I later founded the Tunis-Serpell Lumber Company and built the Norfolk & North Carolina Railroad to transport lumber. He served in Company B of the First Maryland Cavalry in the Civil War. Goldsborough II was a member of the Norfolk Executive Committee Southern Commercial Congress, board chairman of Seaboard Citizens National Bank, and president of the United Owners Realty Corporation in Norfolk. He graduated in 1895 from the Virginia Military Institute in Lexington, Virginia. He married Susan Watkins, an American artist, known for painting in the styles of realism and impressionism, in 1912. Two of her pieces are on permanent display at the Chrysler Museum of Art in Norfolk, Virginia. He died in Norfolk on April 29, 1946, where he had lived since his early childhood.[24]

In January 1955, the officers were Abner S. Pope, president; Roy W. Dudley, executive vice president; J. Bilisoly Hudgins, Cinton J. Curtis, vice presidents; A.L. McCardell, vice president and trust officer; Eugene W. Berard, cashier; Victor L. Howell, comptroller; James R. Land and M. Lee Payne, assistant vice presidents; John R. Moore, George D. Williams, John B. Davis, William C. Brock, assistant cashiers; and James P. Stephenson, auditor. The trust department had Leighton P. Roper and H. Thomas Fennell, trust officers. The directors were D. Baker Ames, George D. Brooke, Forrest F. Cathey, James W. Derrickson, Ralph B. Douglass, Roy W. Dudley, Clyde F. Hill, Richard D. Hofheimer, Leigh G. Hogshire, Paul S. Huber, Jr., J. Bilisoly Hudgins, Isaac W. Jacobs, Eugene L. Parker, Abner S. Pope, William L. Prieur, Jr., George B. Rice, E. Jeff Robertson, Richard W. Ruffin, H.C. Smither, Charles Syer, Jr., Danier E. Taylor, J. Hoge Tyler, III, and Joseph D. Wood. E. Ray Altizer and Monford M. Gregory were the Berkley Branch advisory committee. At the close of business for 1954, the bank had total resources of $69,700,648.39, with capital $1,500,000, surplus and undivided profits, $3,901,393.27, and deposits $63,590,689.10. The York Street Branch had Paul O. Hirschbiel as vice president and S. Heth Tyler, Jr., assistant vice president; Naval Air Station, Alfred P. Randolph, manager and John B. Gibson, Jr., assistant manager; Center Branch, Edward H. Burgess, vice president, T. Martin Walker, asst. manager, and E.H. Strawbridge, manager, installment loan dept.; and Berkley Branch, Ralph W. Porter, vice president and Richmond L. Koonce, Jr., assistant vice president.[25] J. Bilisoly Hudgins, senior vice president of the Seaboard Citizens National bank was rounding out his banking career which began inauspiciously in Portsmouth 54 years ago. His retirement was announced by Abner S. Pope, Seaboard president. Hudgins had been a vice president of Seaboard since the institutions consolidation with the old Citizens Bank of Norfolk in 1928. Prior to that he held the office of cashier of the Citizens Bank which he joined in 1924 after 20 years service on the staff of three other financial institutions in Norfolk and Portsmouth. A native of Portsmouth, Hudgins joined the Merchants and Farmers Bank of that city in 1901 as a runner, but by 1907 he had advanced through various positions of responsibility to assistant cashier of the old Mercantile Bank of Norfolk. He held this post for less than a year when he took advantage of an opportunity to return to Portsmouth as assistant cashier of the old Bank of Tidewater. During World War I, he served in the finance section of the Construction Corps in Virginia and overseas for more than two years. He attained the rank major when he returned to civilian life in 1919. Upon rejoining the staff of the Bank of Tidewater, Hudgins was elected cashier and continued until 1924 when he accepted the same office with the old Citizens Bank of Norfolk.[26]

In June 1962, the president of Virginia's second largest bank announced plans for formation of United Virginia Bankshares Inc., a new bank holding company to be composed of six banks with total resources of $416.6 million. J. Harvie Wilkinson, Jr., president of State-Planters Bank of Commerce and Trusts said the six banks would be State-Planters; First and Citizens National Bank of Alexandria; First National Trust and Savings Bank of Lynchburg; Citizens Marine Jefferson Bank of Newport News; The Vienna Trust Co. of Vienna; and Merchants and Farmers Bank of Franklin. It was decided to form a holding company rather than merge the other banks into branches as would be allowed under a law becoming effective at the end of the month. This would allow further expansion. Each of the six banks would retain its local officers and directors and be able to merge with other banks to provide branches. A petition was filed with the Federal Reserve System's board of governors for permission to become a bank holding company by acquiring 50% or more of outstanding stock of each of the six banks. Approval was also required of the Federal Reserve Board under the Federal Bank Holding Company Act of 1956. The Virginia Commonwealth Corp. was proposed by the Bank of Virginia; the Bank of Salem; and three other institutions in January.[27] On Thursday, December 6, 1962, United Virginia Bankshares, Inc., was approved by the Federal Reserve Board in Washington. Clarence J. Robinson, president of First and Citizens of Alexandria, would serve as director and chairman of the board; L. Burwell Gunn, executive vice president--trusts, State-Planters of Richmond would serve as director and vice chairman of the board; J. Harvie Wilkinson, Jr., president of State-Planters, director and president and chief executive officer.[28]

On Thursday, January 10, 1963, J. Harvie Wilkinson, Jr. of Richmond, president of United Virginia Bankshares Inc., announced the bank holding firm was officially in business. United Virginia Bankshares' dominant bank was State-Planters Bank of Commerce and Trusts, Richmond with $247,600,000 in resources, making UVB the largest bank holding firm in the state.[29]

On January 14, 1964, the Farmers Bank of Holland voted in favor of a plan to merge the bank with Seaboard Citizens National Bank of Norfolk. On January 30th, Comptroller of the Currency James J. Saxon approved the merger. J. Hoge Tyler, III, president of Seaboard Citizens and J.D. Rawles, president of Farmers Bank of Holland jointly made an announcement. The merger, Seaboard's second within three months would combine Holland's only banking institution with Norfolk's oldest and only independent bank serving Tidewater exclusively. Seaboard merged with the Farmers Bank of Nansemond of Suffolk in October 1963.[30]

On Friday, June 3, 1966, Mrs. Julia Regina Crouch, 42, was sentenced to three years in federal prison for embezzling $28,000 from accounts at the Seaboard Citizens National Bank of Norfolk over a 9-year period. Mrs. Crouch, the mother of four, pleaded guilty to the charge and through attorney Richard G. Brydges asked for probation. But U.S. District Court Judge Walter E. Hoffman repeatedly countered Brydges' offer of restitution as impossible. FBI agent Harry L. Cummings was the only prosecution witness, reading a statement from Mrs. Crouch. Her statement said she had been juggling the bank's books for nine years when a fellow employee discovered a $10,000 error she inadvertently had made. She then admitted to bank official she had been taking money. She was arrested March 10th.[31]

On June 22, 1966, Seaboard Citizens National Bank which only recently opened a new banking facility at Holland and had another under construction in Suffolk, announced completion of negotiations for the bank's occupancy of a new 19-story home office building to be constructed between Plume Street and the north side of Norfolk's downtown commercial plaza, the new structure to be known as Seaboard Citizens National Bank Building. The office building would also have an adjacent multi-story parking facility to accommodate 256 cars. The building would overhang an open ground floor lobby. The exterior of the tower would use an alternating patter of light and dark anodized aluminum grid glazed with green-tinted heat-absorbent glass. The 16-foot high first floor lobby would have walls of glass and imported Travertine marble. The cut stone and terrazzo floor would extend to the exterior pave area forming a unified ground floor pattern. The ground lever lobby would offer entrances from any direction and open into an enclosed arcade linking the Mall with Plume Lane. The building was designed by Vlastimil Koubek of Washington DC. Construction would begin immediately with completion set for mid-1968 at a cost of approximately $7,500,000.[32]

In February 1968, the Federal Reserve Board approved a new international bank being organized by United Virginia Bankshares Inc., the Richmond-based bank holding company. The new bank, United Virginia Bank International was expect to begin operations within the next 60 days. J. Harvie Wilkinson, Jr., president of UVB and board chairman of State-Planters Bank of Commerce and Trusts in Richmond would be chairman of the new bank. J. Hoge Tyler III, president of UVB's Norfolk affiliate, Seaboard Citizens National Bank, would be chairman of the executive committee. M. Lee Payne, Seaboard Citizen's executive vice preside would also be president of UVB International along with William J. van Bakel of Norfolk, executive vice president and general manager, and Charles L. Hays, Jr., secretary-treasurer.[34] In addition to Seaboard Citizens National Bank, the other member banks of United Virginia Bankshares were Citizens and Marine Bank, Newport News, Hampton and York County; First and Citizens National Bank, Alexandria, Arlington and Springfield; First National Trust and Savings Bank, Lynchburg; Peninsula Bank and Trust Co., Williamsburg, James City and York Counties; Rockbridge Bank and Trust Co., Lexington; Spotswood Bank, Harrisonburg; State-Planters Bank of Commerce and Trusts, Richmond, Petersburg, Hopewell and Hanover County; and The Vienna Trust Company, Vienna, Tysons Corner, McLean, Great Falls and Reston.[35]

On Wednesday, February 19, 1969, the Seaboard Citizens National Bank in Suffolk, along with 10 member banks of United Virginia Bankshares Incorporated, a registered bank holding company, changed its name and adopted a new emblem. The new name was United Virginia Bank/Seaboard National.[38] The change was announced last December by J. Harvie Wilkinson, Jr., president of United Virginia Bankshares Inc. and M. Lee Payne, president of Seaboard Citizens National Bank.[39]

On Friday morning, November 21, 1969, William Thomas Old, 98, of 900 Jamestown Crescent, Norfolk, died in a Norfolk hospital. He was former president of Seaboard Citizens National Bank of Norfolk.[40]

The historical Belle-Hampton area was settled by James Hoge, father of Gen. James Hoge, about 1770. Gen. Hoge replaced the family's log home with a stately brick mansion about 1826. J. Hoge Tyler, his grandson was born in 1846 in Caroline County but he grew up on his grandparents' Hayfield Plantation, which he later inherited. J. Hoge Tyler Became Virginia's governor at the turn of the century (1898-1902). He became a wealthy man, prospering from the coal mines on his mountain lands and the huge herds of cattle grazing in his fields.[41] J. Hoge Tyler III of Virginia Beach was an attorney for almost 25 years. He became chairman of the board of United Virginia Bankshares Inc. in 1967. He retired as chairman in 1972, but remained a member of the board. He was appointed by the Governor of Virginia as a member of the Virginia Port Authority board.[42]

Official Bank Titles

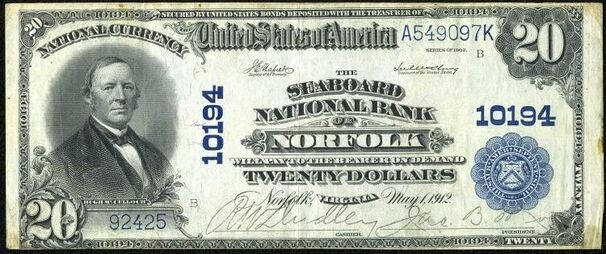

1: The Seaboard National Bank of Norfolk, VA

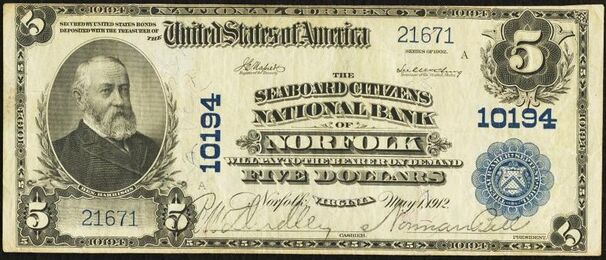

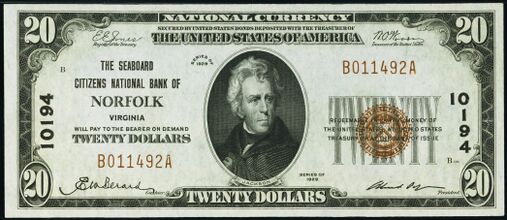

2: The Seaboard Citizens National Bank of Norfolk, VA (6/30/1928)

Bank Note Types Issued

A total of $17,338,695 in National Bank Notes was issued by this bank between 1912 and 1935. This consisted of a total of 2,023,954 notes (1,102,268 large size and 921,686 small size notes).

This bank issued the following Types and Denominations of bank notes:

Series/Type Sheet/Denoms Serial#s Sheet Comments 1: 1902 Date Back 3x10-20 1 - 17700 1: 1902 Plain Back 4x5 1 - 103319 1: 1902 Plain Back 3x10-20 17701 - 135207 2: 1902 Plain Back 4x5 1 - 22266 2: 1902 Plain Back 3x10-20 1 - 14775 2: 1929 Type 1 6x5 1 - 59710 2: 1929 Type 1 6x10 1 - 38666 2: 1929 Type 1 6x20 1 - 12344 2: 1929 Type 2 5 1 - 172671 93607-93612 Not issued 2: 1929 Type 2 10 1 - 82187 2: 1929 Type 2 20 1 - 2508

Bank Presidents and Cashiers

Bank Presidents and Cashiers during the National Bank Note Era (1912 - 1935):

Presidents:

- William Thomas Old (Sr.), 1912-1921

- James Bradshaw Moss, 1922-1926

- Goldsborough Serpell, 1927-1927

- Norman Bell, 1928-1931

- Abner Stephenson Pope, 1932-1935

Cashiers:

- Abner Stephenson Pope, 1912-1918

- James Bradshaw Moss, 1919-1920

- Roy Wilson Dudley, 1921-1931

- Eugene William Berard, 1932-1935

Other Known Bank Note Signers

- No other known bank note signers for this bank

Bank Note History Links

- Seaboard NB/Seaboard Citizens NB, Norfolk, VA History (NB Lookup)

- Virginia Bank Note History (BNH Wiki)

Sources

- Norfolk, VA, on Wikipedia

- Don C. Kelly, National Bank Notes, A Guide with Prices. 6th Edition (Oxford, OH: The Paper Money Institute, 2008).

- Dean Oakes and John Hickman, Standard Catalog of National Bank Notes. 2nd Edition (Iola, WI: Krause Publications, 1990).

- Banks & Bankers Historical Database (1782-1935), https://spmc.org/bank-note-history-project

- ↑ The Virginian-Pilot, Norfolk, VA, Wed., May 15, 1912.

- ↑ Ledger-Star, Norfolk, VA, Fri., Apr. 24, 1914.

- ↑ The Bankers' Magazine, Vol. 89, July - Dec. 1914, pp 322-3.

- ↑ Richmond Dispatch, Richmond, VA, Fri., Feb. 28, 1902.

- ↑ Ledger-Star, Norfolk, VA, Tue., Nov. 6, 1928.

- ↑ Virginian-Pilot, Norfolk, VA, Tue., Feb. 28, 1905.

- ↑ Boston Evening Transcript, Boston, MA, Tue., Mar. 17, 1908.

- ↑ Ledger-Star, Norfolk, VA, Tue., Jan. 11, 1910.

- ↑ The Virginian-Pilot, Norfolk, VA, Wed., May 15, 1912.

- ↑ Ledger-Star, Norfolk, VA, Fri., Apr. 24, 1914.

- ↑ Ledger-Star, Norfolk, VA, Wed., Jan., 15, 1919.

- ↑ Ledger-Star, Norfolk, VA, Wed., Jan. 11, 1922.

- ↑ Ledger-Star, Norfolk, VA, Wed., Mar. 8, 1922.

- ↑ The Virginian-Pilot, Norfolk, VA, Sat., Apr. 29, 1922.

- ↑ The Virginian-Pilot, Norfolk, VA, Sun., June 25, 1922.

- ↑ The Virginian-Pilot, Norfolk, VA, Tue., May 9, 1922.

- ↑ The Virginian-Pilot, Norfolk, VA, Wed., May 30, 1928.

- ↑ The Virginian-Pilot, Norfolk, VA, Wed., May 30, 1928.

- ↑ The World-News, Roanoke, VA, Fri., June 29, 1928.

- ↑ Ledger-Star, Norfolk, VA, Mon., July 2, 1928.

- ↑ Ledger-Star, Norfolk, VA, Wed., May 25, 1932.

- ↑ Ledger-Star, Norfolk, VA, Thu., Jan. 7, 1932.

- ↑ Ledger-Star, Norfolk, VA, Wed., May 25, 1932.

- ↑ The Virginian-Pilot, Norfolk, VA, Wed., May 1, 1946.

- ↑ The Portsmouth Star, Portsmouth, VA, Sun., Jan. 2, 1955.

- ↑ The Virginian-Pilot, Norfolk, VA, Thu., Jan. 13, 1955.

- ↑ The Roanoke Times, Roanoke, VA, Tue., June 12, 1962.

- ↑ The News and Advance, Lynchburg, VA, Fri., Dec. 7, 1962.

- ↑ Richmond Times-Dispatch, Richmond, VA, Fri., Jan. 11, 1963.

- ↑ Suffolk News-Herald, Suffolk, VA, Thu., Jan. 30, 1964.

- ↑ Richmond Times-Dispatch, Richmond, VA, Sat., June 4, 1966.

- ↑ Suffolk News-Herald, Suffolk, VA, Wed., June 22, 1966.

- ↑ The Virginia Gazette, Williamsburg, VA, Fri., Mar. 29, 1968.

- ↑ Richmond Times-Dispatch, Richmond, VA, Thu., Feb. 22, 1968.

- ↑ Suffolk News-Herald, Suffolk, VA, Wed., Mar. 27, 1968.

- ↑ Suffolk News-Herald, Suffolk, VA, Sun., Feb. 23, 1969.

- ↑ Suffolk News-Herald, Suffolk, VA, Sun., Oct. 4, 1981.

- ↑ Suffolk News-Herald, Suffolk, VA, Thu. Feb. 20, 1969.

- ↑ Suffolk News-Herald, Suffolk, VA, Mon., Dec. 2, 1968.

- ↑ The Sentinel, Winston-Salem, NC, Fri., Nov. 21, 1969.

- ↑ Roanoke Times, Roanoke, VA, Tue., Aug. 9, 1988.

- ↑ Daily Press, Newport News, VA, Tue., Nov. 11, 1975.