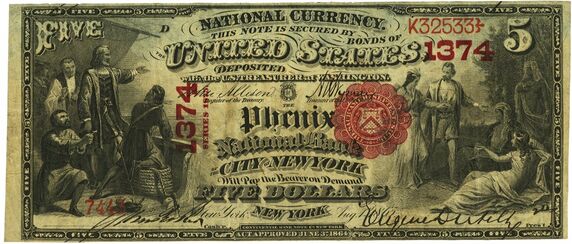

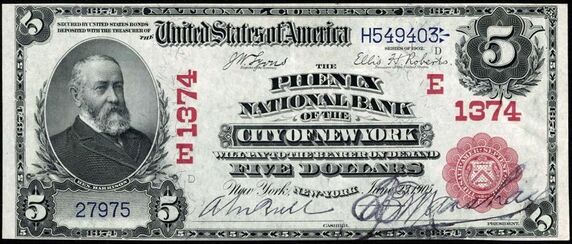

Phenix NB of the City of New York, NY (Charter 1374)

Phenix NB of the City of New York, NY (Chartered 1865 - Liquidated 1911)

Town History

New York, often called New York City or NYC, is the most populous city in the United States. With a 2020 population of 8,804,190 distributed over 300.46 square miles, New York City is the most densely populated major city in the United States. The city is more than twice as populous as Los Angeles, the nation's second-largest city. New York City is located at the southern tip of New York State. Situated on one of the world's largest natural harbors, New York City comprises five boroughs, each of which is coextensive with a respective county. The five boroughs, which were created in 1898 when local governments were consolidated into a single municipality, are: Brooklyn (Kings County), Queens (Queens County), Manhattan (New York County), the Bronx (Bronx County), and Staten Island (Richmond County). New York City is a global city and a cultural, financial, high-tech, entertainment, glamour, and media center with a significant influence on commerce, health care and scientific output in life sciences, research, technology, education, politics, tourism, dining, art, fashion, and sports. Home to the headquarters of the United Nations, New York is an important center for international diplomacy, and it is sometimes described as the world's most important city and the capital of the world.

New York had 180 National Banks chartered during the Bank Note Era, and 143 of those banks issued National Bank Notes.

Bank History

- Organized June 13, 1865

- Chartered July 1, 1865

- Succeeded Phenix Bank

- Liquidated March 28, 1911

- Consolidated with 1375 (Chatham NB/Chatham and Phenix NB, New York, NY)

- Notation on Organization Report: Exception #5

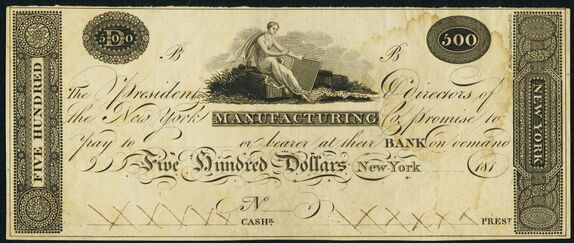

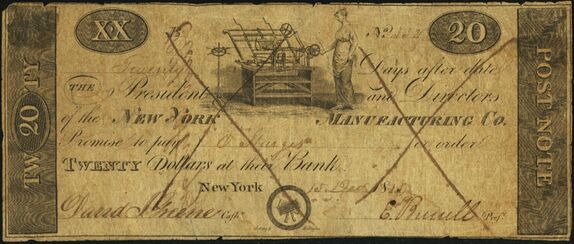

In June 1812, the New York Manufacturing Company was one of three banking companies recently incorporated in New York City. This and the declaration of war had to some degree depressed the market price of bank stock. The principles upon which the New York Manufacturing Company, sometimes called "the Wire Bank", was established differed greatly from those of mere banking companies. The capital was $1,200,000 of which $250,000 would be expended towards establishing the manufacture of wire and of cotton and wool cards. When done, the company could engage in banking operations, but would be required to invest $50,000 annually in manufactures until the whole sum expended and employed amounted to $500,000. At the time, articles of wire could hardly be said to be manufactured in the United States, yet without a supply, the whole manufacture of cotton and woolen goods would cease. Wire was so scarce it was selling for 5-600% higher than it did before the commencement of the commercial restrictions. On Monday, June 29, 1812, at a meeting of the President and Directors of the Company, Cornelius Hever, Esq., was unanimously elected cashier. The books for subscription were opened at the Long Room of the Phoenix Coffee House on Wednesday, July 8th at 10 o'clock a.m. for 24,000 shares at $50 par. The sum of $2.50 on each share was required at the time of subscription. E. Burrill was president.[2] The directors were Anthony Post, John L. Van Kleeck, Isaac Marquand (of Marquand & Paulding), Samuel Whittemore, Ebenezer Burrill, Silvanus Miller, George Fitch (of Howard Fitch & Lloyd), Noyes Darling (of Darling & De Forest), Reuben Crump (of Kelso & Crump), Abram Bussing, Barent Gardinier, Eliphalet Williams, David S. Jones, and John King, Jr., (of King & Bonner).[3]

The Phenix Bank

The New York Manufacturing Company was originally chartered in June 1812, with a capital of $700,000.[4] In June 1817, the President and Directors of the New York Manufacturing Company gave notice that in conformance to an act of the Legislature of New York passed at the last session, they would assume on July 1st the name and style of The President and Directors of the Phenix Bank. The bank notes of the Company in circulation would continue to be received and paid in common with the new notes issued. D.I. Greene was cashier.[5] On July 1, 1817, the following gentlemen were elected directors of the Phenix Bank: James Boggs, Anthony Post, John P. Durand, Eliphalet Williams, Peter Harmony, Samuel St. John, Samuel Whittemore, Lebbeus Loomis, William Cairus, Samuel Leggett, Josiah Sturges, John Colvill, Benjamin Marshall, and Moses Judah. The next morning the directors unanimously appointed James Boggs, Esq., president.[6]

In July 1822, spurious $10 bills purporting to be of the "Phenix Bank of New York" signed Edw'd Cuyler, Cashier and H. Slidell, President, had been recently offered in Northampton. The genuine bills of that bank were signed by James Boggs, president, and John Delafield, cashier. The counterfeits were well executed.[7]

The Phenix Bank one of New York's old banking establishments, was number seven in the clearing house.[8]

On August 9, 1833, James Boggs, president of the Phenix Bank responded in a letter to the Bank of the United States on the subject of transferring the business of the latter, including the transfer of the deposits of the Government. The directors were listed as D.S. Jones, Abm. Valentine, David Bryson, Henry Cary, C.V.S. Roosevelt, M.W. Grinnell, John Gray, Benj. Smith, John Robins, Henry Parish, G. Sharpe (State), H. Russell, J.W. Otis, and Robert Ray. John Delafield was cashier and R.K. Delafield, assistant cashier.[9]

In April 1838, the directors were David Bryson, J.S. Crary, George Sharp, John Robins, Henry Parish, Garrit Storm, M.H. Grinnell, John Gray, James W. Otis, Robert Ray, Benjamin Curtis, James Donaldson, and James Campbell. There remained one vacancy. M.H. Grinnell was president; N.G. Ogden, cashier; and William Van Hook, notary.[10]

At an election held on July 2, 1850, the following gentlemen were elected directors for the ensuing year: Thomas Tileston, James W. Otis, Thomas W. Gale, Daniel B. Bearing, Israel Corse, William Bryce, Eugene Dutilh, Henry Cary, M.H. Grinnell, Joshua J. Henry, Drake Mills, Elbert J. Anderson, William F. Cary, B.F. Dawson. At a subsequent meeting of the board, Thomas Tileston, Esq., was elected president and Henry Cary, Esq., assistant president. N.G. Ogden was cashier.[11] The quarterly statement of June 29, 1850, showed total resources of $4,512,797.23, with capital $1,200,000, profits $118,767.83, old emission bank notes in circulation $2,604, registered bank notes in circulation $238,864, and deposits $1,990,281.07.[12]

In March 1864, Peter M. Bryson, esq., was elected president of the Phenix Bank to fill the vacancy caused by the death of Mr. Tileston, and John Parker, esq., was appointed cashier.[13] Mr. Thomas Tileston died February 29th, aged 71 years. His house was one of the oldest and most eminent of the city of New York and had long engaged in its shipping interests. The first connection of Mr. Tileston with the shipping business was under the firm of Spofford & Tileston about the year 1822. He was president of the Phenix Bank, No. 45 Wall Street, and a director of the new Second National Bank of New York.[14][15]

John Delafield

On Saturday, October 22, 1853, John Delafield, Esq., 67, of Seneca County, New York, died at his residence of disease of the heart. This gentleman, who, at the time of his death was President of the Board of Trustees of the Agricultural College, recently incorporated, was for a great portion of his life distinguished in the financial, commercial, and literary circles of New York City. The Delafield family emigrated from England to the city of New York, a short time before the war of the Revolution. The father of the subject of this notice also named John Delafield, who, soon after the peace of 1783, engaged in the auction and brokerage business, being particularly concerned in the purchase and sale of government securities, in which large fortunes were made after the adoption of funding system recommended by Alexander Hamilton, John Delafield the elder, who died the about the year 1812, advanced age of 83 years, left five sons and four daughters. The sons were John, the subject of this sketch; Richard, a major in the U S. Army, and Superintendent of the Military Academy at West Point from 1838 to 1845; Edward, one of our most eminent physicians; Joseph and Rufus K. Delafield, officers in Wall Street institutions. John Delafield was a native of this city, born in 1786, and graduated from Columbia College. Having received mercantile education, he visited England, in connection with a commercial enterprise of some importance, remained in Great Britain during the war of 1812, and for some years after the peace of 1815 was engaged in financial transactions in that country. After his return to the United States, he was appointed one of the tellers in the Bank of New York, and subsequently, through the influence of the late Nathaniel Prime, of the firm of Prime, Ward & King, he received the appointment as cashier of the Phenix Bank. This institution was originally chartered in June 1812, under the title of "The New York Manufacturing Company," with a capital of $700,000. The ostensible object of this company was the manufacturing of wire, which was established on a large scale by the company at Greenwich village, now in the Ninth ward. It was difficult to procure the incorporation of a banking company in those times from the legislature of this State, and it was therefore deemed good policy for applicants to connect such institutions with manufacturing operations during the war of 1812, when the manufacture of articles of prime necessity was encouraged by acts of the legislature. The bank subsequently sold its wire manufactory to Timothy Whittemore, Esq., and employed its capital exclusively in financial operations, its name being changed by the legislature to that of "the Phenix Bank." Before this change, an unfortunate defalcation took place in the funds of the institution, by the conduct of the cashier, Mr. David I. Greene, who had stood high in the confidence of the company, and of the public, until the astounding development of his embezzlement of the funds, and his disappearance from the city was made publicly known. Mr. Delafield was appointed the successor of Mr. Greene as cashier of the bank, and an act of the Legislature was obtained, by which the capital was reduced to $500,000, a reduction from the original capital of $200,000, due to the defalcation of Mr. Greene, and other losses. This was about the year 1822, and from that time the bank, under the auspices of Mr. Delafield, James Boggs, the President, and others, moved on generally in prosperity for many years. The institution was, during the war of 1812, and for several years afterwards, a favorite bank with individuals and companies connected with the business of manufacturing and the sale of American manufactures. The late T.B. Wakeman, the founder the American Institute, and who was early engaged promoting domestic manufactures in this State, was one the originators of the bank now called the Phenix Bank and was one of the first directors of the company. After Mr. Delafield and his friends became connected with the institution, and the wire manufactory was disposed of, the name of the company also being changed to that of the Phenix Bank, the transactions of the bank became confined principally to accommodations of merchants, brokers, and speculators. About 1834 the capital of the Phenix Bank was increased to $1,500,000, and a few years afterwards Mr. Delafield was appointed president of the institution. He had then become one of the most prominent financiers of Wall Street and took an active part in the measures of General Jackson's administration which led to the deposit of the funds of the United States government in the State banks, the Phenix Bank being one of the favored institutions.

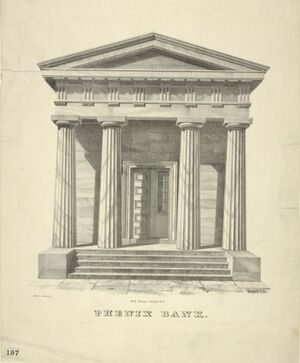

Mr. Delafield was also an active agent for the State of Illinois, in negotiating the loans for that State, and transacted an immense business as negotiator and agent for States and moneyed institutions at the West and South; but in the midst of all this paper prosperity, the grand financial crush of 1837 came, and the Phenix Bank and Mr. Delafield came in for their share of the troubles. On a change in the direction, about the time Mr. Delafield became President of the Bank, some of the knowing ones among the stockholders, (Mr. John Robbins an old and shrewd merchant and director being of the number) sold out their stock, and the value of the bank shares rapidly declined. To add to their troubles, the bank was charged by the Legislature with usurious and other illegal transactions. The Assembly sent a committee to this city to investigate the concerns of the bank. and Mr. Delafield and the other directors of the bank were examined before the committee, during their tedious sessions at the City Hotel. This was in 1838 or 1839. The bank was finally exculpated with some censure, but the circumstance induced Mr. Delafield to resign his office in the bank. He then established and became the head of the New York Banking Company, an institution formed under the general banking law, but this concern was only of short duration. A few years after this, Mr. Delafield retired from the banking business and in 1842 removed to a beautiful farm in Seneca County near the banks of the Seneca Lake, where he turned his attention to the science of agriculture, and has since distinguished himself for his zeal and exertions in promoting the cause of agricultural knowledge. The statistics of the industrial capacities and pursuits of Seneca county, taken under his Auspices, will compare favorably in minuteness and practical value, with those collected and published under similar circumstances by Sir John Sinclair in Scotland. In 1852 Mr. Delafield presided at the annual Fair of the State Agricultural Society and had recently established a model farm in Seneca County, for which, as an agricultural college, he obtained a charter from the Legislature. Mr. Delafield, while a resident in his native city of New York, was a zealous promoter of the cause of science and literature. He endeavored to introduce the Grecian style of architecture into Wall Street in the building he caused to be erected for the use of the Phoenix Bank, but a taste for this classic style of architecture was found to interfere with the interests of a utilitarian age. Mr. Delafield's Grecian temple, therefore had disappeared to make room for a more profitable edifice in the way of convenience and rents. He was one of the officers of the Lyceum of Natural History, and treasurer of the New York Historical Society. The latter institution, however, was not very prosperous while Mr. Delafield held the keys of the treasury, and the late Doctor Hosack was president. The receipts into the treasury were insufficient to pay the annual expenses, and for a time the library was closed. The Rev. Doctor Hawkes is entitled to the credit of reviving the society’s funds, by infusing energy among the members, introducing new dues, and aiding the funds by his lectures particularly by his popular one on Pocahontas.

In 1811 and afterward, Mr. Delafield was among the most forward of our citizens in the formation of the University of the City of New York, which was chartered in 1847, and opened in 1852 for the reception of students, and took a prominent part in calling the celebrated Literary Convention which met in this city about that time, and over which body John Quincy Adams presided. The extensive financial transactions in which Mr. Delafield was engaged for a large portion of his career, brought him into circumstances of peculiar difficulty, and made him many enemies in Wall Street for a time; but we are disposed to think favorably of his attempts to prove himself useful to society, by his efforts in the cause of agriculture, literature and science, while so many men of financial education and pursuits lived only for themselves, and have gone down to the grave, unwept, unhonored, and unsung.[16]

The Phenix National Bank

On September 15, 1865, Henry B. Jenkins was arraigned in the Court of General Sessions. Jenkins was attended by his counsel, ex-Judge Stuart and pleaded not guilty. Trial was set for the first Monday in October. The Grand Jury returned two indictments against Jenkins, former acting paying teller for embezzlement and grand larceny from the Phenix National Bank.[18] Chas. Brown, alias Samuel Davis, charged with receiving part of the $300,000 embezzled by Jenkins, the acting teller from the Phenix National Bank of New York, was committed in default of $5,000 bail.[19] Mr. Jenkins, 49, had been engaged in the Phenix Bank for nearly 20 years and for the past two years as paying teller. Up to this time he was regarded as an honest, upright and perfectly trustworthy gentlemen. John Parker, Esq., cashier of the bank, made out an affidavit against Jenkins of feloniously stealing diverse sums of money of $250,000 and property of the Phenix National located at 45 Wall Street.[20] In October District Attorney Hall said the prosecution was not ready, having received notice from counsel of Jenkins that the prisoner desired to make a plea, one that would require careful consideration. The case of Brown or Brower, the lover of "Genevieve," the girl to whom Jenkins gave large sums of money, was also on the calendar. It was decided that a motion for the discharge of Brown who was held partly as a witness against Jenkins might be argued. It was expected the plea would render Brown's evidence unnecessary.[21]

The directors elected January 1872 were Moses H. Grinnell, Thomas W. Gale, Israel Corse, William Bryce, William F. Cary, Eugene Dutilh, Elias Ponvert, James Low,, Simon De Vissar, Peter M. Bryson, Charles P. Hemenway, John Parker, Daniel G. Bacon, and Jonathan Thorne, Jr. Peter M. Bryson was president; Eugene Dutilh, vice president; John Parker, cashier; and E.H. Riker, notary public. The bank was located at No. 45 Wall Street, with capital, as of December 1871 of $1,800,000, surplus and profits $274,000.[22]

In January 1877, at a meeting of the stockholders of the Phenix National Bank, it was agreed to reduce the capital stock from $1,800,000 to $1,000,000 by returning at par in cash the amounts of the reduction to the shareholders pro rata. The saving to the bank in taxation was estimated at about $30,000 a year.[23]

On January 8, 1889, at the annual election the following gentlemen were elected directors for the ensuing year: Eugene Dutilh, Chas. P. Hemenway, Daniel G. Bacon, Jonathan Thorne, John H. Pool, George L. Nichols, Clarence W. Goold, Henry R. Kunhardt, Rudolph Pagenstecher, Alfred M. Bull, John L. Boardman, John C. Milligan, William H. Malo, and Pierson G. Dodd. At a subsequent meeting of the board, Mr. Eugene Dutilh was unanimously re-elected president, and Mr. George L. Nichols, vice president.[24]

On Tuesday, April 26, 1892, at a meeting of the board of directors, Mr. Wm. H. Hale was unanimously elected vice president in the place of Mr. George L. Nichols, deceased.[25]

On Tuesday, January 9, 1900, at the annual election, the following gentlemen were elected directors for the ensuing year: Jonathan Thorne, John H. Pool, Alfred M. Bull, W.H.H. Moore, Lewis F. Whitin, Duncan D. Parmly, Henry K. Pomroy, Anton A. Raven, George M. Coffin, Henry G. Wisner, Le Roy W. Baldwin, Henry S. Deshon, Daniel Bacon, and George L. Nichols. At a subsequent meeting of the board of directors, Mr. Duncan D. Parmly was re-elected president and Mar. Geo. M. Coffin, vice president, both unanimously. Alfred M. Bull was cashier.[26]

In January 1901, the officers were Duncan D. Parmly, president; George M. Coffin, vice president; Alfred M. Bull, cashier; and Pierson G. Dodd, assistant cashier. The bank was located at 62 Wall Street.[27]

On Tuesday, January 14, 1902, Henry P. Talmadge took the place on the board of E.W. Moore of the Everett-Moore Syndicate.[28] On Sunday, June 29, 1902, Pierson G. Dodd, ex-president of the Common Council and a lifelong resident of Newark, New Jersey died in the summer of his sister, Mrs. Caroline V. Stoutenburgh at Allenhurst. Apoplexy was the cause of death. Mr. Dodd who was 65 years old was assistant cashier of the Phenix National Bank of New. He had been connected with the bank for 38 years.[29]

On April 1, 1905, according to a statement made by F.E. Marshall, vice president of the National Bank of Commerce of St. Louis, the sock of the Phenix National Bank of New York had been purchased by J.P. Morgan & Co., August Belmont & Co., F.E. Marshall and his associates of the National Bank of Commerce in St. Louis, and E.F. Swinney, president of the First National Bank of Kansas City, Missouri. Mr. Marshall would become president of the new Phenix National Bank and move to New York where he would take charge of and complete the financial organization and the board of directors would be named. Mr. Marshall in 1892 became vice president of the National Bank of Commerce in Kansas City and in 1902 he was chosen vice president of the National Bank of Commerce of St. Louis which position he would resign to take the presidency of the Phenix. George M. Coffin, a director of the Phenix National said "Six moths ago George C. Warner of the law firm of Goldsborough, Warner & Sykes, purchased a control of the bank's stock. The St. Louis dispatch is the first intimation I have had about who Mr. Warner acted for or sold the stock to." The president of the bank, Duncan D. Parmly, had been ill for a month and had devoted little attention to the bank's affairs., Mr. Coffin and A.M. Bull, the cashier assuming the active executive management.[30]

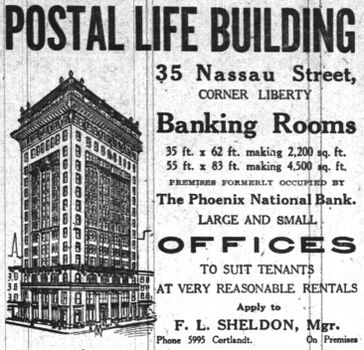

In May 1910, the directors were August Belmont, August Belmont & Co.; E.W. Bloomingdale, capitalist; Alfred M. Bull, vice president; B. Crawford Clark, Clark, Dodge & Co.; Elbert H. Gary, chairman, U.S. Steel Corp.; R.H. Higgins, Harvey Fisk & Cons; Henry K. Pomroy, Pomroy Bros.; Edwin A. Potter, president, American Trust & Savings Bank, Chicago; Wm. Pierson Hamilton, J.P. Morgan & Co.; Edward Shearson, Shearson, Hammill Co.; Frederick D. Underwood, President, Erie Railroad Co.; Robert P. Perkins, president, Hartford Carpet Corp.; George Coffing Warner, attorney; Finis E. Marshall, president. The officers were Finis E. Marshall, president; Alfred M. Bull, vice president; B.L. Haskins, cashier; and H.C. Hooley, assistant cashier. The bank was located on the corner of Nassau and Liberty Streets with capital $1,000,000 and surplus and undivided profits $725,000.[31] In December 1910, a syndicate was formed for the purpose of purchasing the stock of the Phenix National Bank with the idea of merging that institution with the Chatham National Bank. George C. Warner and William A. Law were the managers of the syndicate, representing an important out-of-town interest that had acquired control of the Chatham National some time ago. The institution resulting from the merger would be known as the Chatham and Phenix National Bank with capital and surplus of $3,000,000 and deposits of about $20 million. Louis G. Kaufman, president of the Chatham National Bank would head the merged bank. The year 1911 would be the 100th anniversary of the Phenix National. Its capital was $1,000,000 and it had surplus and undivided profits of $759,578. The Chatham Had a capital of $450,000 and its surplus and undivided profits amounted to $1,012,400.[32]

The most important consolidation of banking interests in 1910 was the amalgamation of the Fifth Avenue Trust Company, the Morton Trust Company and the Guaranty Trust Company. In the last month of the year, two old and well-known banks united--namely the Chatham National Bank and the Phenix National Bank.[33] In March 1911, the following directors of the Chatham and Phenix National Bank were elected following the recent merger of these two banks: George M. Hard, chairman of the board; Louis G. Kaufman, president; Frank J. Heaney, William H. Strawn, and Alfred M. Bull, vice presidents; Bert L. Cadmus, Norborne B. Gatling, Walter B. Boice, and Henry C. Hooley, assistant cashiers. Among the directors of the old Phenix National who would become directors of the merged bank were August Belmont, Pierre S. du Pont, E.H. Gary, and Frederick D. Underwood.[34] [Note: The Belmont Stakes for three-year old Thoroughbreds run at Belmont Park in Elmont, NY, is named for its financier, August Belmont.]

Official Bank Title

1: The Phenix National Bank of the City of New York, NY

Bank Note Types Issued

A total of $6,892,710 in National Bank Notes was issued by this bank between 1865 and 1911. This consisted of a total of 807,000 notes (807,000 large size and No small size notes).

This bank issued the following Types and Denominations of bank notes:

Series/Type Sheet/Denoms Serial#s Sheet Comments Original Series 3x1-2 1 - 9000 Original Series 4x5 1 - 15500 Original Series 3x10-20 1 - 9200 Original Series 50-100 1 - 2600 Series 1875 4x5 1 - 10385 Series 1875 3x10-20 1 - 6278 Series 1875 50-100 1 - 2000 1882 Brown Back 4x5 1 - 21984 1882 Brown Back 3x10-20 1 - 8973 1882 Brown Back 50-100 1 - 200 1902 Red Seal 4x5 1 - 46500 1902 Red Seal 3x10-20 1 - 29800 1902 Date Back 4x5 1 - 18624 1902 Date Back 3x10-20 1 - 23106

Bank Presidents and Cashiers

Bank Presidents and Cashiers during the National Bank Note Era (1865 - 1911):

Presidents:

- Peter McCartee Bryson, 1865-1882

- Eugene Dutilh, 1883-1894

- Duncan Dunbar Parmly, 1895-1904

- Finis Everett Marshall , 1905-1910

Cashiers:

Other Known Bank Note Signers

Bank Note History Links

Sources

- New York, NY, on Wikipedia

- Don C. Kelly, National Bank Notes, A Guide with Prices. 6th Edition (Oxford, OH: The Paper Money Institute, 2008).

- Dean Oakes and John Hickman, Standard Catalog of National Bank Notes. 2nd Edition (Iola, WI: Krause Publications, 1990).

- Banks & Bankers Historical Database (1782-1935), https://spmc.org/bank-note-history-project

- The Miriam and Ira D. Wallach Division of Art, Prints and Photographs: Print Collection, The New York Public Library. (1824 - 1900). Phenix Bank Retrieved Nov. 8, 2025.

- ↑ The New York Times, New York, NY, Fri., Mar. 24, 1911.

- ↑ The Evening Post, New York, NY, Tue., June 30, 1812.

- ↑ The Evening Post, New York, NY, Thu., June 18, 1812.

- ↑ New York Daily Herald, New York, NY, Wed., Oct. 26, 1853.

- ↑ The Evening Post, New York, NY, Tue., June 24, 1817.

- ↑ The Evening Post, New York, NY, Wed., July 2, 1817.

- ↑ The Evening Post, New York, NY, Sat., July 13, 1822.

- ↑ The Wall Street Journal, New York, NY, Thu., May 2, 1912.

- ↑ The Evening Post, New York, NY, Tue. Jan. 21, 1834.

- ↑ New York Daily Herald, New York, NY, Tue., Apr. 24, 1838.

- ↑ The Evening Post, New York, NY, Mon., July 8, 1850.

- ↑ The Evening Post, New York, NY, Tue., July 11, 1850.

- ↑ New-York Tribune, New York, NY, Thu., Mar. 10, 1864.

- ↑ New-York Tribune, Mon., Jan. 25, 1864.

- ↑ New York Daily Herald, New York, NY, Tue., Mar. 1, 1864.

- ↑ New York Daily Herald, New York, NY, Wed., Oct. 26, 1853.

- ↑ The Bankers' Magazine, Vol. 73, July-December 1906, p. 302.

- ↑ The Philadelphia Inquirer, Philadelphia, PA, Fri., Sep. 15, 1865.

- ↑ The Baltimore Sun, Baltimore, MD, Sat., Sat. Sep. 2, 1865.

- ↑ Lancaster Daily Intelligencer, Lancaster, PA, Sat., Aug. 12, 1865.

- ↑ The Brooklyn Daily Times, Brooklyn, NY, Mon., Oct. 9, 1865.

- ↑ The Bankers' Magazine, Vol 26, July 1871-June 1872, p. 691.

- ↑ The Pittsburgh Weekly Gazette, Pittsburgh, PA, Wed. Jan. 24, 1877.

- ↑ New-York Tribune, New York, NY, Sat., Jan. 12, 1889.

- ↑ New-York Tribune, New York, NY, Wed., Apr. 27, 1892.

- ↑ The New York Times, New York, NY, Thu, Jan. 11, 1900.

- ↑ The New York Times, New York, NY, Mon., Jan. 7, 1901.

- ↑ The Sun, New York, NY, Wed., Jan. 15, 1902.

- ↑ The New York Times, New York, NY, Wed., July 2, 1902.

- ↑ The New York Times, New York, NY, Sun., Apr. 2, 1905.

- ↑ The Wall Street Journal, New York, NY, Tue., May 24, 1910.

- ↑ The Wall Street Journal, New York, NY, Fri., Dec. 21, 1910.

- ↑ New-York Tribune, New York, NY, Mon., Jan. 2, 1911.

- ↑ The Sun, New York, NY, Sat., Mar. 4, 1911.